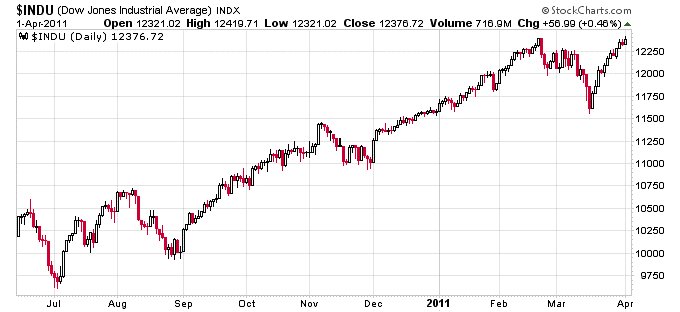

The market continued higher this week and has essentially gone straight up for the last two weeks straight since bottoming in mid-March. What’s noteworthy about this recent rally is two of the lagging indexes, the Russell 2000 and Transports, have been the best performers over the last two weeks and have made new highs for the year. In particular for the Transports this is interesting because oil has continued to make new highs over the last few weeks. The following charts show the recent V-shaped bounce in the major market indexes:

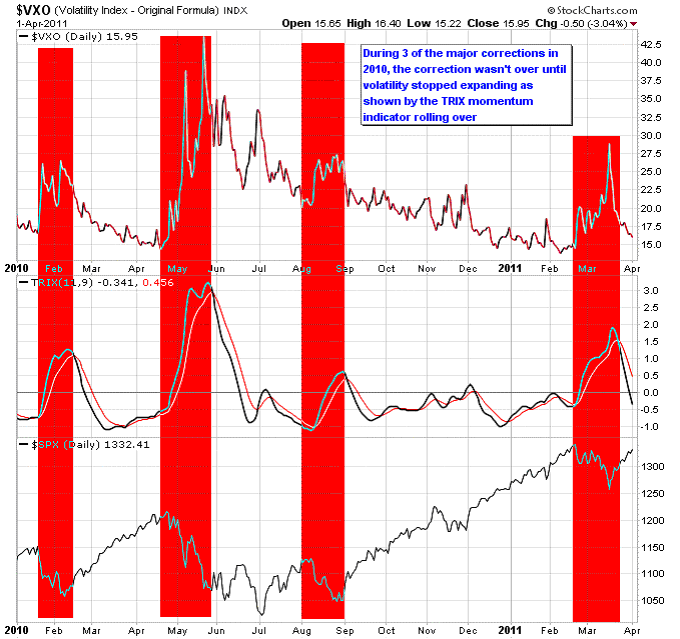

The spike in volatility that accompanied the mid-March market pullback has now settled back down. Until volatility starts to spike up again the market will most likely grind higher from here. The chart below shows that the TRIX has rolled over on the Volatility Index signaling the end of this recent stock market pullback.

Dominic Frisby wrote a thought provoking article on the uranium industry last week entitled “The Bull Market In Uranium Is Over”. In the article he cited two major factors that could derail the bull market in uranium that looked so promising just a few weeks ago, before the crisis in Japan. Those two factors are: 1) public sentiment against nuclear power and 2) two new uranium mines that will greatly increase worldwide production of uranium once they come online. The two new sources of uranium are still years away from production but the market will undoubtedly price them in to the overall supply/demand mix before they come online.

From a stage analysis perspective, when uranium gapped down on high volume a few weeks ago it also halted its Stage 2 advance. Typically when such a major selloff occurs a period of repair needs to take place on the chart. This is because an overhead supply of sellers exists now at the former higher prices, since they will look to make their losing positions whole again if uranium were to move back higher. This same situation exists on uranium mining stocks that were also hit hard. Uranium most likely now needs to build another Stage 1 base again and move the weak hands back into strong hands before another Stage 2 advance can occur.

Gold looks like it might be ready to end it’s near 5-month consolidation. As can be seen on the chart gold hit $1425 an ounce way back in November 2010 and has failed to significantly breakout past that level ever since then. Gold hasn’t violated its uptrend however and it looks like only a matter of time before it breaks out from here.

Gold should be aided by the fact that the dollar is in a Stage 4 decline as it is moving lower below a declining 30-week moving average. This is extremely bearish for the dollar, especially since it is making a new yearly low and is approaching its 2009 low.