The stock market had a strong week last week with the Nasdaq leading the way up 2.01% for the week. Semiconductors (up 4.10%) and Oil Services (up 3.38%) were the two best performing sectors last week. Silver once again led commodities higher closing up 8.40% for the week. Silver is now up 23.72% for the month and less than 4% off its biggest monthly gain since May of 2009 when it closed up 27.2% for the month.

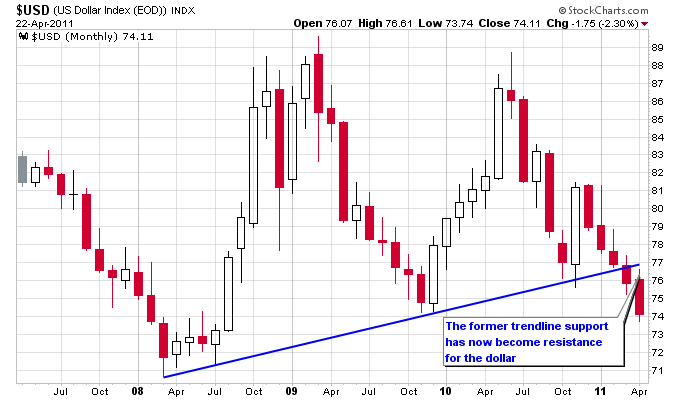

The financial markets are clearly benefiting from the ongoing decline in the dollar. Since topping in June 2010, the dollar has now declined 9 out of the last 11 months. The dollar is also breaking down out of a massive 3-year trading range that began in 2008. This breakdown if it continues is extremely bearish for the dollar since it reaffirms the long term trend lower for the dollar. The chart below is a monthly chart of the dollar. Notice how the lower trendline has now become resistance for the dollar as it failed to move back above the trendline after testing it this month.

A lot of gold bulls have identified the failure of gold, gold stocks, and even silver stocks to keep up with the pace of silver as a potentially bearish sign for the gold and silver market in the near future. If you look at gold, gold stocks, silver, and silver stocks from a simple trend following perspective, the current trend higher is still intact. The frustration for owners of gold and silver stocks is they want to be rewarded for taking the extra risks of owning mining companies, instead of simply the metal itself. The reward for this risk is supposed to be better performance than the metal when gold and silver are going higher. Instead silver has outperformed almost all of the major silver stocks during this rally and gold stocks have only been able to keep pace at best with gold, and not outperform gold. On the next two graphs below you can see that from August 2010 to the end of January 2011, silver stocks at least kept pace with silver, and gold stocks had just a slightly better performance than gold. But from the start of February until now silver has vastly outperformed, including against silver miners which are supposed to be leveraging silver.

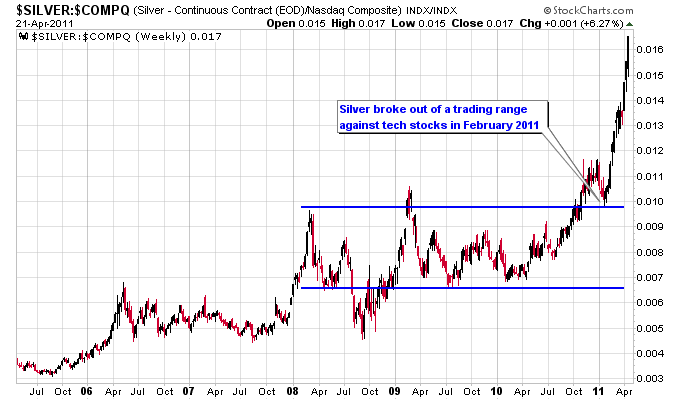

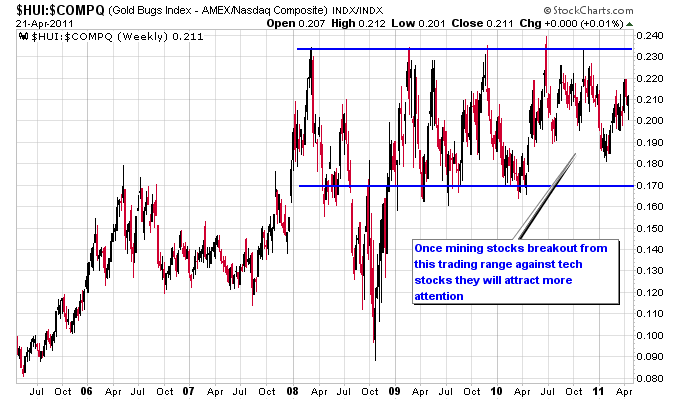

In my opinion patience is needed with the gold and silver stocks. As Jesse Livermore used to say, “be right and sit tight”. One reason I believe the market is not recognizing the value being created for the gold and silver miners right now is the solid performance by the rest of the stock market. The combination of a little more focus being put on gold and silver miners with a little less focus on the rest of the market could be the push gold and silver stocks need to get going. In the next few charts you can see that in February of this year silver broke out against the Nasdaq, which has led to a lot of new focus being put on silver. Once mining stocks breakout against tech stocks I expect gold and silver miners will regain the focus of Wall Street and have a chance of outperforming their underlying metals.

Turning to silver itself, the question is whether silver can continue this massive rally higher? The main negative for silver is it’s gone parabolic on the chart and is extremely stretched against its long term moving averages. Overbought indicators are flashing red on everyone’s charts, which is causing some traders to try and short into this spike higher. On the positive side for silver though as I’ve noted recently, gold and gold stocks are not seeing anywhere close to the speculation that silver has, which is unusual. This could mean that even though silver is stretched, the move for the precious metals sector as a whole isn’t over yet, which means silver should continue to go higher with the sector. Silver also has a dollar downtrend at its back. Finally even though silver has moved tremendously higher, it is still in backwardization in the futures markets. This suggests demand for silver is still extremely strong even with the big move silver has already had. The next table shows the backwardization in silver, with the near term futures prices higher than the prices of later dated contracts.

Source: Barchart.com

Gold on the other hand is not in backwardization, as evidenced by the table below. It will be interesting to see what price of silver removes the backwardization condition in the silver futures market.

Source: Barchart.com