Markets tend to have no set rules that always work. Especially on shorter term time frames. But as you stretch the time frame out to the longer term general guidelines start to form for how markets behave. This includes concepts such as bear markets following bull markets, and bull markets following bear markets. Periods of overvaluation in stocks tend to be followed by periods of undervaluation. And relationships between asset classes tend to switch as one asset class becomes extremely overvalued or undervalued against another. The market hates extremes so by definition trends that reach extremes tend to eventually reverse.

With that being said one of the oldest trends in the market right now that is also sitting at an extreme is long gold, short gold miners. If you follow the gold market at all, you know that gold went up for 12 years in a row, then had a horrific 2013 as it finally had a major correction. That was previously one of the longest trends in the market to finally experience a major reversal. Which in gold’s case was a bull market finally going through a bear market. But within the gold trend the relationship of gold outperforming gold miners has been in place since 2006! Gold stocks have been in a bear market versus gold for over 8 years!

Now one thing to note is not all gold stocks have performed as badly versus gold as others. It’s basically been a stock pickers’ market for gold stocks since the mid-2000s. If you picked the right gold stocks you could still acheive outperformance versus gold. Also gold stocks did have a major bounce from late-2008 until early-2011, where they did outperform gold. But that bounce did not negate the overall trend of lower gold stocks versus gold, starting way back in 2006.

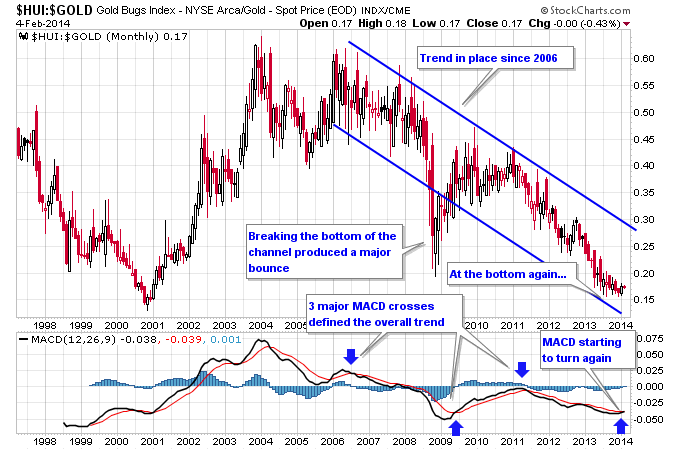

The chart below, comparing the HUI Gold Miners Index versus gold on a monthly time frame, shows how this has unfolded. After forming a double top versus gold from 2004 to 2006, with a negative divergence in the MACD, gold stocks started trending lower versus gold. Then as the financial panic hit in 2008, gold stocks got smashed, and dropped completely out of the trend channel to the downside. This setup a trading opportunity though where gold stocks rebounded versus gold. And they had a powerful rally which brought the relationship back to the top of the channel. But then as if to help forecast gold’s major top in the fall of 2011, gold stocks resumed the trend lower versus gold which continued into late 2013. Notice though that the MACD didn’t make a lower low in late 2013, which is setting up a positive divergence in momentum. Also note that MACD is about to turn back higher again, and this is a rare occurrence as the 3 major MACD crosses defined the overall trend lower. The final crossover of the MACD higher, at the bottom of the trend channel, could be where this trade is about to finally reverse.

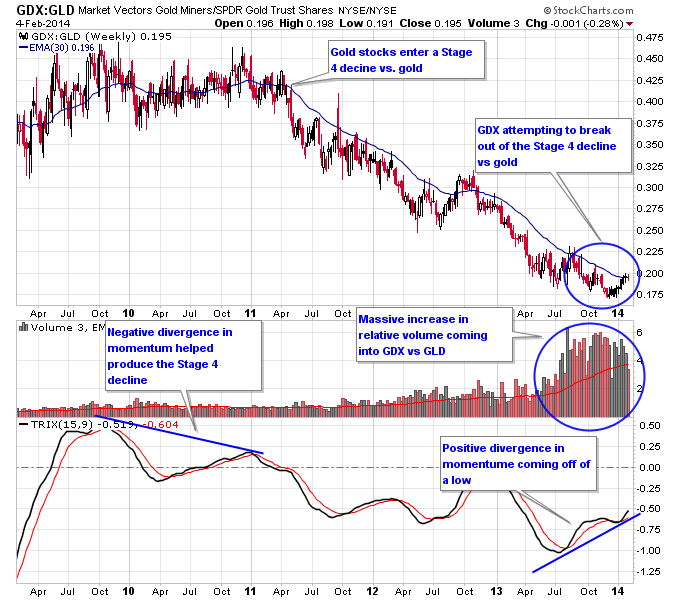

Now let’s zoom in on a more recent chart, a weekly comparison of the GDX gold miner’s ETF versus the gold ETF GLD. After the bounce ended in early 2011, gold stocks entered into another Stage 4 decline versus gold. A big negative divergence in momentum helped forecast this transition. Then besides a bounce in 2012 the Stage 4 decline has remained intact until early 2014. But notice the massive increase in volume coming into GDX vs. GLD that started in mid-2013, which is coincidentally where gold bottomed. At the same time momentum started moving higher, and has setup a positive divergence versus the price action. Both volume and momentum are indicating a possible trend change once again, as money flows back into the gold stocks relative to gold.

Even if you’re not convinced gold has reached a major bottom yet, like most of Wall Street, the relationship between gold and gold stocks is still worth watching. Because big moves come from old trades that are finally ready to unwind, and this is one of the oldest trades in the market currently.

Connect with me on Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.