I think we have an interesting setup in gold and silver here. Back in May, after a 2-month decline, gold pulled a fast one on the bears and surged higher producing a fake breakdown. But that surge petered out and gold topped in July, then went on another 2-month decline into September. I would say that the bearishness on gold this time around feels pretty similar to the bearishness into May.

The key difference between these gold declines too has been the dollar. In the previous decline, the dollar was muted, just drifting sideways. I think the dollar rally from May though effectively capped the gold rally and caused gold to drift lower after it topped in July.

But now we have an FOMC statement that I believe will be dovish, and given the fact that the dollar has rallied so much, I think commodities in general are in position to rally off of Fed news. They’re simply at a sentiment extreme that could be unwound with a bullish impetus.

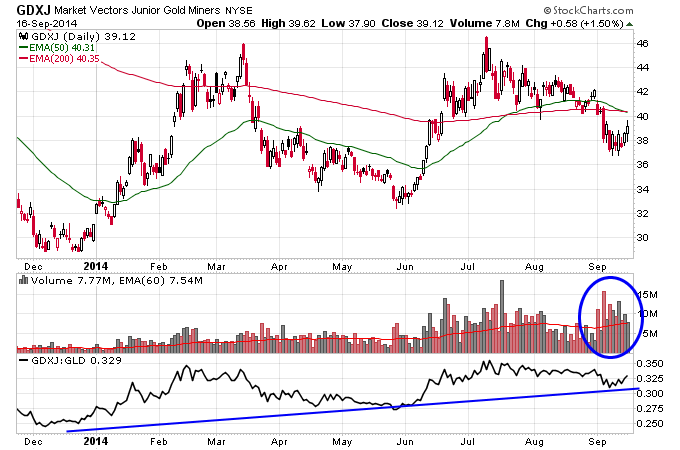

If you look at GDXJ below you can see some strong accumulation days on volume, 3 of them in fact in the last 4 trading sessions. This is also following a 15 million share puke out in early September. Plus GDXJ continues to outperform GLD, all year I might add. And GDXJ can quickly get back above the 50 and 200 dma, causing the trend following funds to get back on board the long side.

I’d also note that strong gold stocks like FNV, TAHO, RGLD, GG, and even NEM, continue to make higher highs, and higher lows. Finally there were notable surges in junior miners this week including DRD, TRX, LSG, THM, ANV, GSS, and AKG, some of them on heavy volume. I could be completely wrong but things could get interesting to the upside tomorrow.