Last week I observed some very extreme sentiment from both the bulls and bears on gold and silver that was really quite striking. On the bear side I saw one technical analyst I follow (that is usually bullish on the metals) state that he “is tired or hates gold and silver”, something I hadn’t seen him ever admit before. A podcast I follow where they normally are bullish on gold and silver basically said there was no reason to buy gold and silver, and they didn’t see any reason why it wouldn’t keep going down. That podcast has also basically capitulated on being bearish on the general stock market. I saw Business Insider had an article entitled “Gold Looks Like Death” written by one of their prominent dollar bulls, basically rubbing it in the face of anyone bullish on gold or silver.

On the bear side of the metals I see very exuberant and overly confident commentary from the bears. I see an all out attack now on dollar bears from the likes of CNBC and Business Insider who proclaim that dollar bears and gold bulls have gotten it wrong for too long now and need to give up. In reality the gold bulls have been wrong since September 2011, but they were right from 2001 until September 2011. The bulls have been wrong during this recent bear market in the metals but it’s still left to be seen if the secular gold bull is actually over or not. But the bears in the metals are super confident given the fact metals have declined for 3 years now and silver recently broke support.

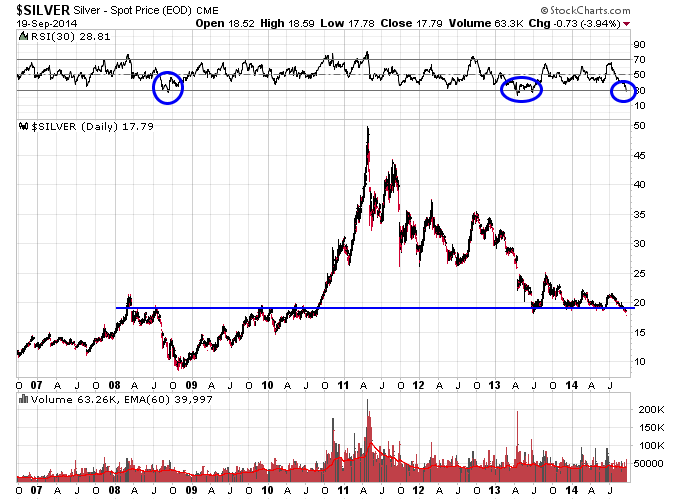

Looking at a long term chart of silver you can see that we are in rare oversold territory here, with the 30-day RSI only getting under 30 a couple of other times in the last 7 years. You can see why it took so long for silver to break support too with former resistance acting as strong support for a long time. I see a couple of different scenarios here but the bottom line is probably that silver will decline somewhat further before bottom. It’s possible it gets into the 15s but I would be surprised if it fell much further than that. With capitulation in the air I think it’s very close to the final bottom of this bear market.