The small speculator category of the commitment of traders report in gold is now the most net short it has been of gold in the past 13 years. The small specs are often considered the “dumb money” because they are not hedging production like commercial traders and don’t have as deep of pockets as the large specs. Each time they have been net short in the past two years it has been at a major low in gold. They were net short in April 2013, July 2013, January 2014, and now in October 2014 with their biggest net short position yet.

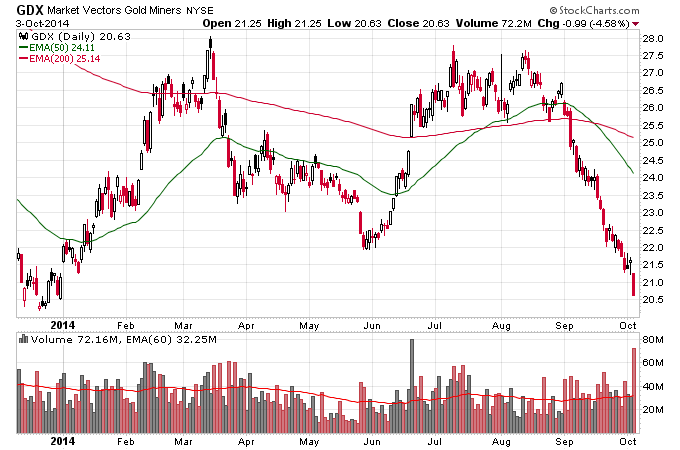

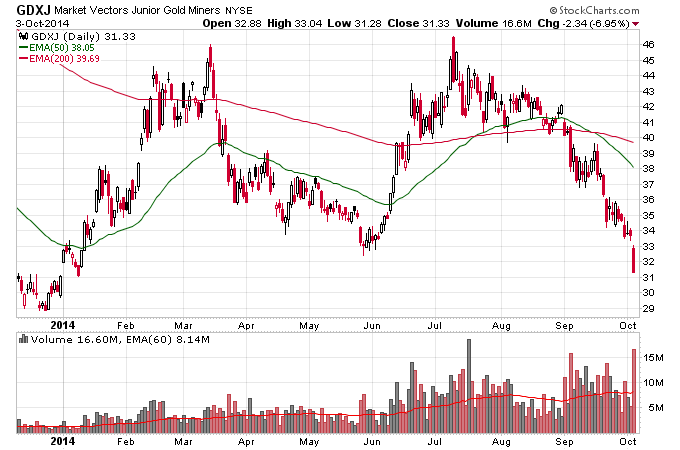

Meanwhile there were signs that the precious metals complex is undergoing a final liquidation of all terrified longs who can’t take it anymore. GDX and GDXJ both had their biggest downside volume days of 2014 this past Friday, and GDXJ actually had its biggest liquidation day ever. Considering this is coming after a 3-month down move it is quite possible this amount of selling will help create at least a temporary bottom.