One thing that I’ve tried to get myself to do more and more when I think about relationships between asset classes is understand this: relationships between asset classes do not stay perpetually the same. For example the dollar and gold do not always trade inverse to each other.

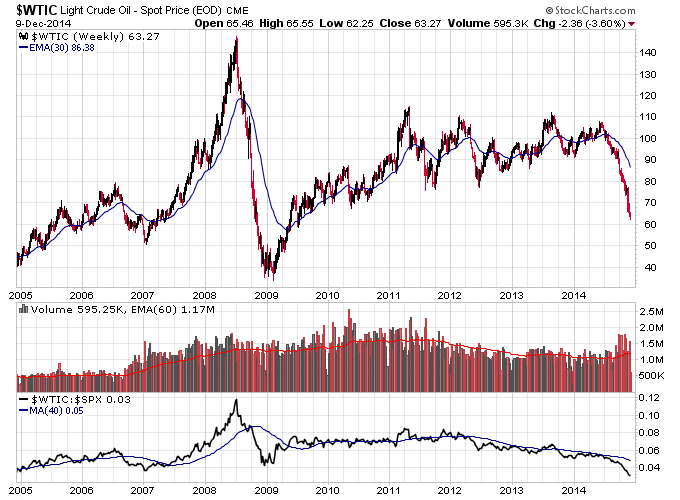

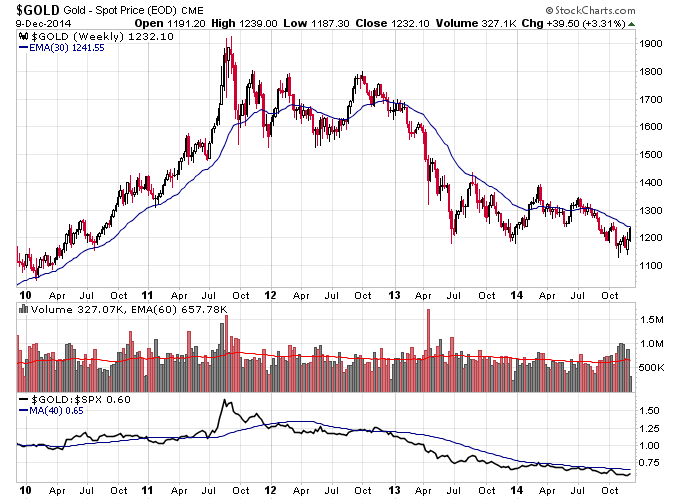

With that being said two assets that are usually positively correlated but not always are gold and oil. But take a look at gold’s long term chart vs. oil’s long term chart. Both markets have been in a bear market since 2011, but oil has been in a sideways bear market without a lot of downside (until recently) and gold has been in a sideways to down bear market with more basing action over the past year.

I would submit that oil probably needs to base for a while down here before it can end its bear market. Gold on the other hand has been basing for a while and with some more strength could start to really hammer in the final part of its base before a new bull market starts. So gold is out of phase with energy here and I think it could be set to get even more out of phase in the near future. This will confuse people who expect their relationship to hold but it doesn’t have to.

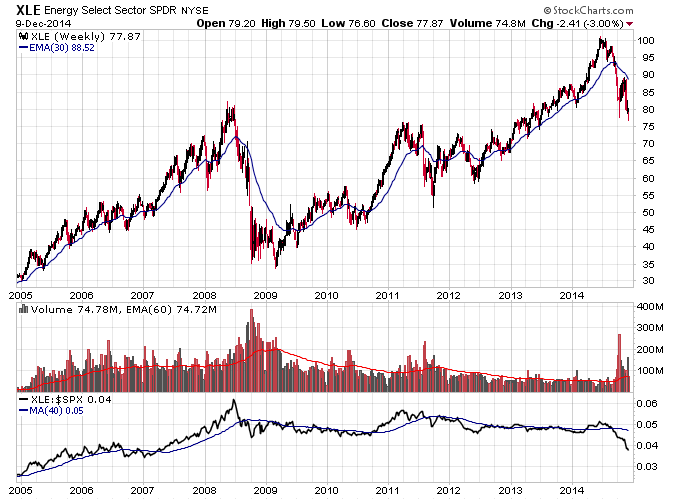

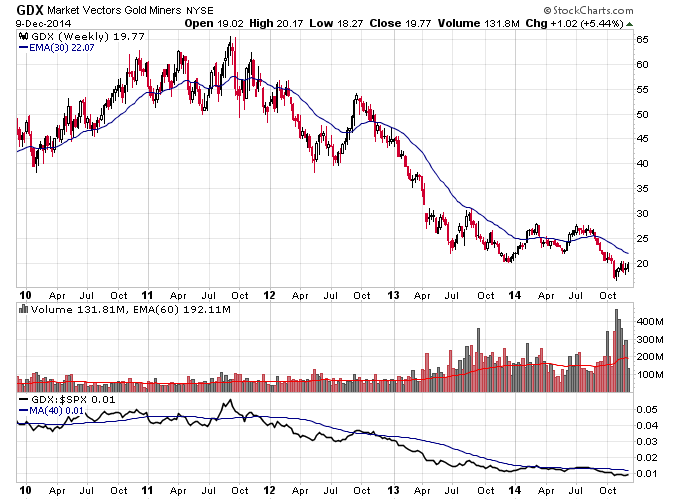

What’s even more totally out of phase with each other are gold and oil stocks. Oil stocks are actually more correlated with the general stock market than oil which is hard to believe but generally true. If you take a look at XLE you see a bull market since 2009 which goes right along with the bull market in stocks. Gold stocks on the other hand as shown by GDX have been in a bear market since 2011.

Energy stocks are now either in a Stage 3 consolidation at best, or a Stage 4 bear market at worst. Gold stocks on the other hand are in a late Stage 4 bear market, or a Stage 1 base. And if they rally more from here they will be in position to break into a new bull market. So gold and energy stocks are totally out of phase with each other as far as where they are in their respective cycles.

One other thing to note is that it’s possible that the gold to oil ratio makes new highs when gold transitions back into a bull market. People on TV will probably come out saying oil is cheap compared to gold so buy oil, but that won’t be a good trade until oil is done completing its basing phase.