The problem with the current stock market is you have a bunch of sectors in U.S. markets that have ran hard for years and are overvalued and over-loved. If you look across markets there just aren’t many nice extended basing patterns that look primed to breakout. In 2012 and 2013 there were things like biotech, semiconductors, airlines, etc. that broke out of large basing patterns into new bull markets that propelled the markets higher. In 2014 these trends continued but nothing else started to setup into a new base breakout that would push the markets higher in 2015.

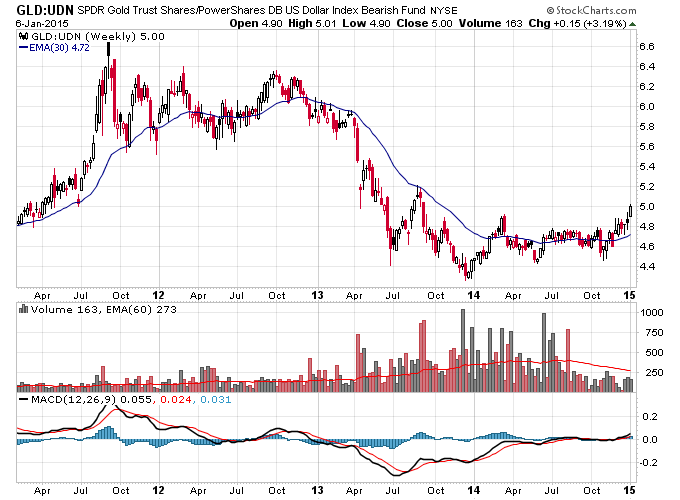

Two of the only sectors that I see that are setting up massive basing patterns are gold and uranium. Gold broke to a new low at the end of 2014 with the rapid rise in the dollar. But the new low could easily be just a part of the basing pattern that has been building since the middle of 2013. In fact gold is now breaking out in terms of foreign currencies from a massive basing pattern.

Only in terms of U.S. dollars is gold still in a base. So once the U.S dollar pauses to digest its gains, which is inevitable, gold might be able to finish off its base in dollars and complete the transition into a new bull market.