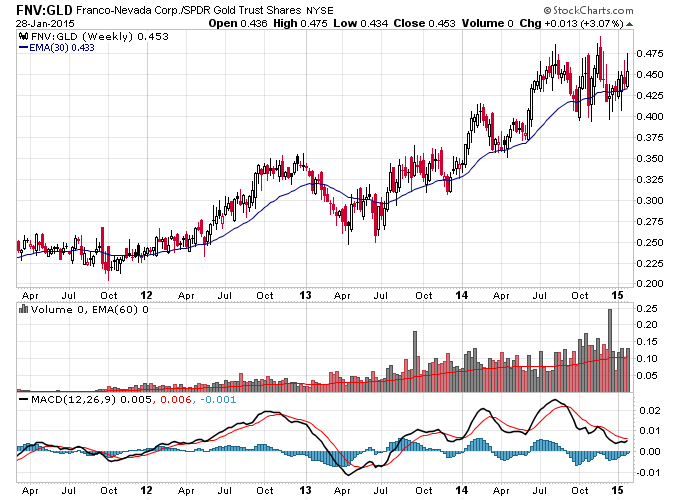

It’s hard to pinpoint just exactly where the gold bear market that started in 2011 ended, because it depends who you ask. For instance if you just would have owned more equivalent shares of FNV for every share of GLD owned, you would never even experienced a bear market, according to the ratio between the two.

It’s pretty rare to see a gold stock outperform gold during an entire bear market in gold but Franco-Nevada has managed to do that.

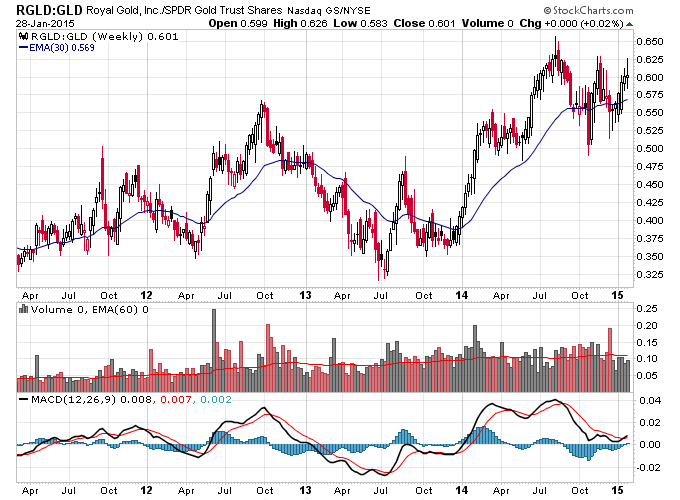

For most of the stronger gold stocks, the bear market in gold ended at the end of 2013. Take a look at another gold streamer, RGLD, and how it rocketed higher against gold starting in 2014.

For all intents and purposes the gold bear market in U.S. dollars probably ended at the end of 2013 as well. But 2014 was a consolidation year for gold that kept people confused and scared that the gold bear market was still going strong. Plus the crazy parabolic rally in the U.S. dollar at the end of 2014 caused a marginal new low in gold and hammered the weaker gold mining stocks down to super cheap levels compared to gold.

It’s taken a long time for this gold bear market to bull market transition to take place. But the process is ongoing as stronger gold stocks and gold priced in foreign currencies lead the transition back into a bull market, which then should be followed by the rest of the sector.