Shorting the market is incredibly hard and not nearly as profitable as going long a new bull market. You usually have to use leverage to get the type of returns you can achieve in a bull market. The only thing a bear market does better than a bull market typically is to move much faster than a bull market which can give a well-timed trade rapid gains in a short period of time. But as I said timing bear markets is not easy.

Technically most of the major averages and market sectors are in Stage 2 advances, but underneath that veil many stocks are tracing Stage 3 topping patterns and are under distribution. Furthermore there aren’t many sectors that are “setting up” for another major advance. The market needs leadership sectors to keep powering higher. Here’s also some general notes on the current market environment which I believe makes the long side a tough side to get bullish on:

- Market is overvalued, CAPE for U.S. stocks one of the highest readings ever

- Market participants are extremely complacent after a long bull market

- The amount of money in bear market funds is at record lows

- The VIX bottomed in July 2014 and has been steadily rising since then

- Leadership in the market is very thin (biotech, semiconductors, airlines)

- Many growth stocks look awful and are tracing out Stage 3 topping patterns

- It’s possible banks are going to start blowing up which tends to cause market meltdowns, the culprit this time is crashing oil prices which crashes banks that gave out subprime fracking loans

- Crashing currencies can topple governments and crush earnings of multinational companies, and hammer hedge funds that are over-leveraged in the currency markets

- Revenue growth is virtually non-existent, most of the Dow components have declining revenues

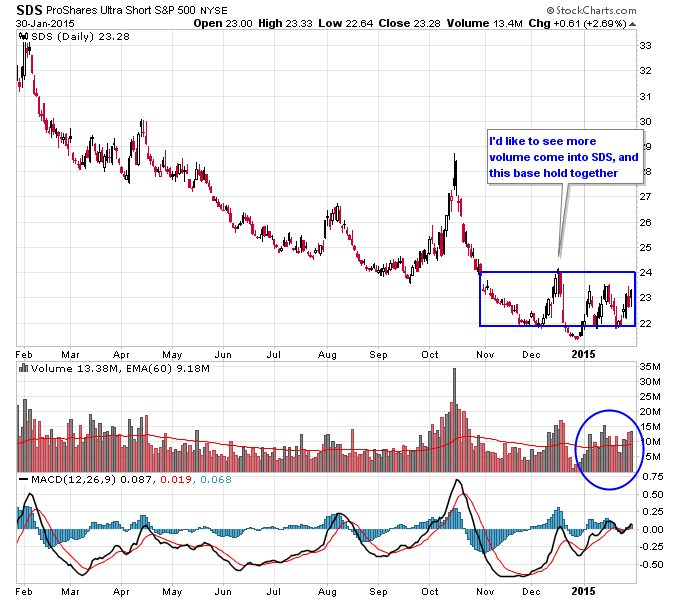

To play the short side I’m starting to stalk SDS and see if it starts acting right. I like to keep an eye on big volume moves in these inverse ETFs which tells me that big money is getting in to hedge long positions and play the short side. Right now we’re seeing some accumulation in SDS but not overwhelming volume that would make me more interested.

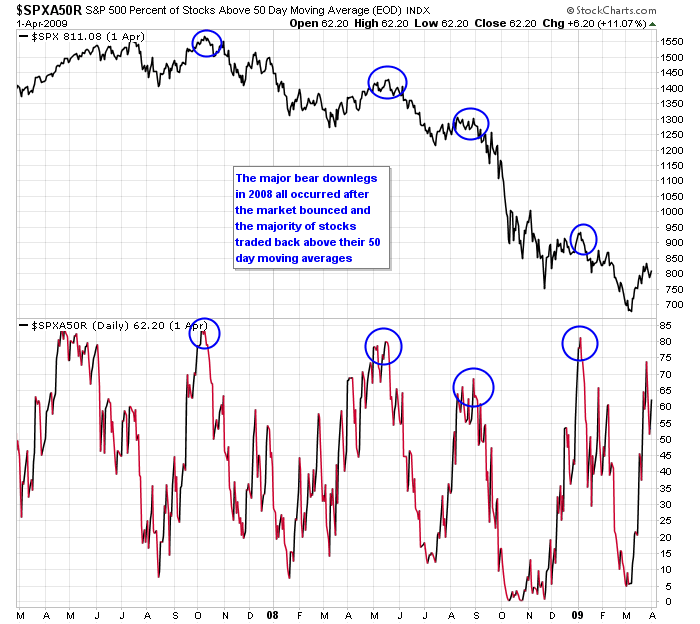

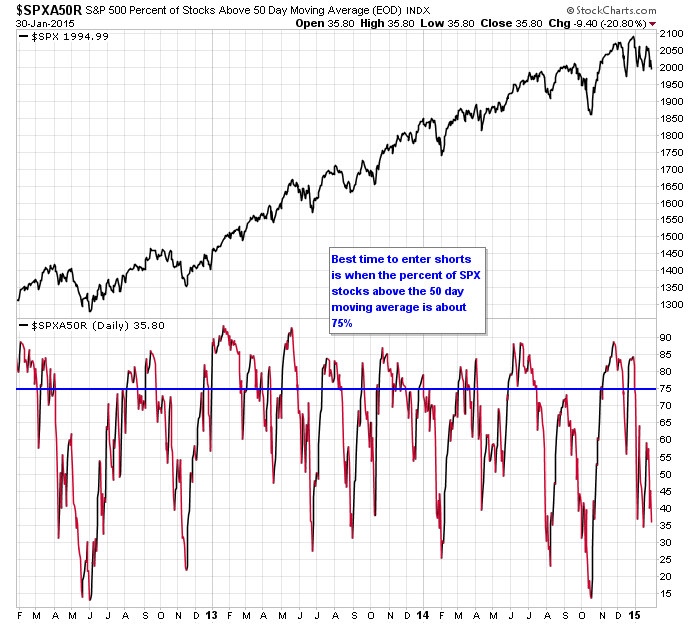

Plus the best time to enter short positions is when 75% of stocks or more in the S&P 500 are trading above their 50 day moving average. If you look at the market decline in 2008 any time the percentage was above 70-80% was the ideal time to get short. But this is also the hardest time to get short as counter trend rallies are often the most convincing right at the top.

Right now the S&P 500 is at 36% so it’s definitely not the ideal time to enter short positions. Therefore I’m waiting for a rally first and also I will pay attention to any leadership sectors in the market that form or don’t form. If the market doesn’t add more leadership then it will show its hand that the internals are continuing to deteriorate.

So to conclude it’s a very early time to even think about shorting the market and looking for a bear market. The market should show it’s hand more on the next rally and that will be a lower risk time to get short. If we see more deterioration in market sectors, combined with a failure to form any type of leadership, the short side will start looking even better.