If you would have told a silver bull in April 2011 or a gold bull in September 2011 where gold and silver would be trading now they would probably laugh at you and shake their head. Yet that is the reality of the markets and how drastic things can change when bull markets and bear markets end.

As far as the U.S. dollar goes, I think we are approaching a major top to its multi-year bull market. And its quite ironic because the media has not been this bullish on the U.S. dollar in perhaps 15 years, at least I can’t remember them being this bullish on the dollar since the turn of the century.

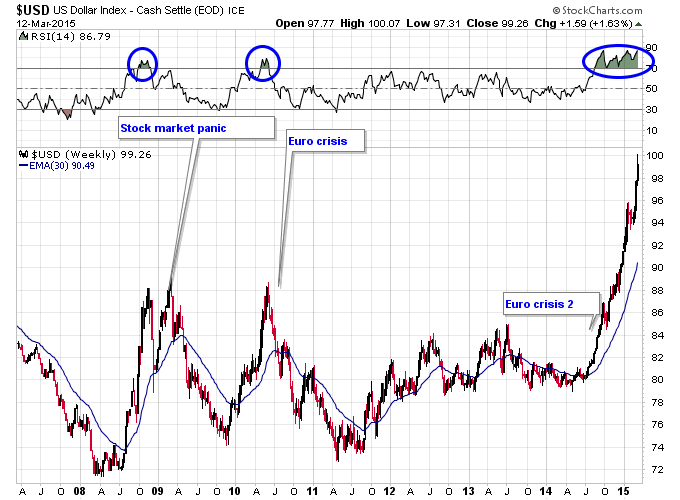

In this weekly chart of the dollar you can see that the dollar put in a major bottom in 2008, right when everyone hated it the most. Then it had two significant rallies and declines heading into 2011, which was another period of time where dollar bears were very vocal. I remember specifically in mid-2011 when a Bernanke speech was supposed to send the dollar off a cliff. Instead it turned out to be a major bottom for the dollar.

Right now we are in the middle of perhaps one of the most extreme moves in the currency markets we might see for a long time. But underneath it all we have to acknowledge that this dollar bull is old, it’s been around since 2008 on a longer term basis and since 2011 on a shorter term basis.

This parabolic top in the dollar which is likely the end of this bull market has major implications for gold investors as gold is now in position to take over leadership of the markets. Bonds, stocks, and cash have now all experienced multi-year bull markets and each one of those is overvalued and is in danger of money looking for the exits. Of the three I think the stock bull market has the potential to go on for a while longer, maybe even a year or so, but fortunes will be made buying cheap and unloved gold stocks pretty soon. It’s almost like the rest of the markets have baked themselves into a corner and the refuge will be the undervalued markets, of which gold is the king right now.