Few people on the Internet that discuss trading talk about going to cash and staying out of the markets for an extended period of time. But the problem is the market doesn’t always trend higher with no volatility like it did from the election in November 2016 until now. Increased volatility occurs from time to time and the best way to deal with it in my opinion is to raise cash and reduce position sizes. It’s much easier to manage that than try and get fancy with hedging and putting on even more positions just to manage existing positions.

Three ways I use the Stage Analysis Screener to get a health gauge of the market are the following:

- Get a comparison of the number of stocks breaking out vs. topping out and moving lower

- Develop a list of sectors leading the market

- Develop a list of stocks I want to trade in sectors that are leading the market

When I look for stocks I want to get a general sense that more money is out there buying stocks than selling stocks so more stocks should be moving higher than breaking down. After that I want to find the strongest sectors where the big money is flowing, and by looking at the charts of stocks in those sectors I want to find the best breakout candidates. Usually when the market starts to weaken it gets a lot harder to do those things which makes it easy to tell the market is weakening and it’s time to raise cash.

When you raise cash and reduce position sizes you reduce the affect of volatility on your positions which allows you to hold those positions through big pullbacks when they occur in a volatile market. Otherwise you’ll be forced to sell positions at a loss if you stick to your risk management and this can happen over and over again if the market goes into a choppy sideways trading range.

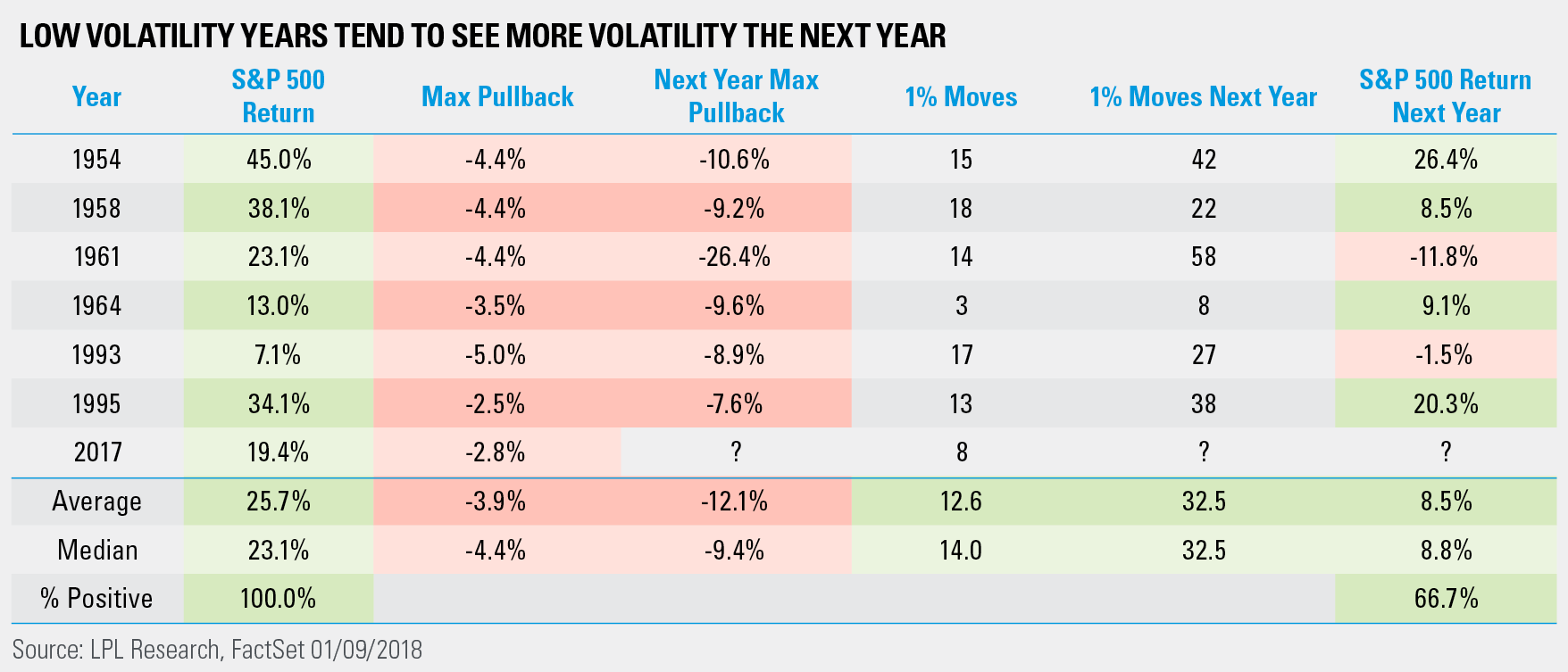

Source: LPL Research

It’s essentially a slam dunk that the market will be more volatile this year than it was in 2017 if you look at the graphic above. Another recent tidbit I saw today was that the pullback today was the first 0.6% loss since September 5th of 2017. Incredible lack of volatility for multiple months which is what contributed to the massive gains that occurred for the last four months of 2017.

As a trader using a trend following process such as Stage Analysis my job isn’t to go out and find stocks to trade. I let the trades come to me by surveying the market and finding stocks that fit my criteria of early Stage 2 explosive uptrends. If I can’t find those stocks then it’s time to raise cash and get defensive and wait for a better market. That’s exactly what I’ve done recently by taking the heaviest cash position I’ve had in over a year and I’ll stay defensive until I see leadership sectors forming again and high quality setups to trade.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.