Oversold isn’t a buy signal, but it does give an indication of excessive bearish sentiment that is unsustainable over the short term. It’s impossible for a market to remain scared to death for too long because it eventually runs out of sellers and buyers push the market back higher. At that point you have to re-evaluate and either prepare for the next downleg in a bear market or if it’s the last bear downleg start getting ready for a new bull market.

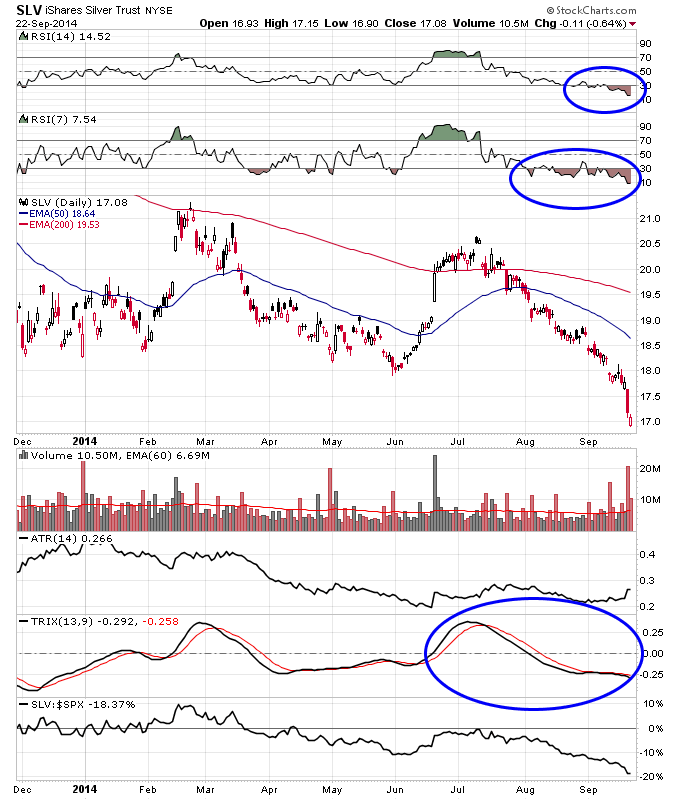

Silver has been just obliterated over two months, but it’s also overdue for a major bounce. Silver has been oversold for two months now which is very rare and is at an oversold low for the year. Look for a crossover in the TRIX to indicate that this downleg is at least temporarily taking a break.

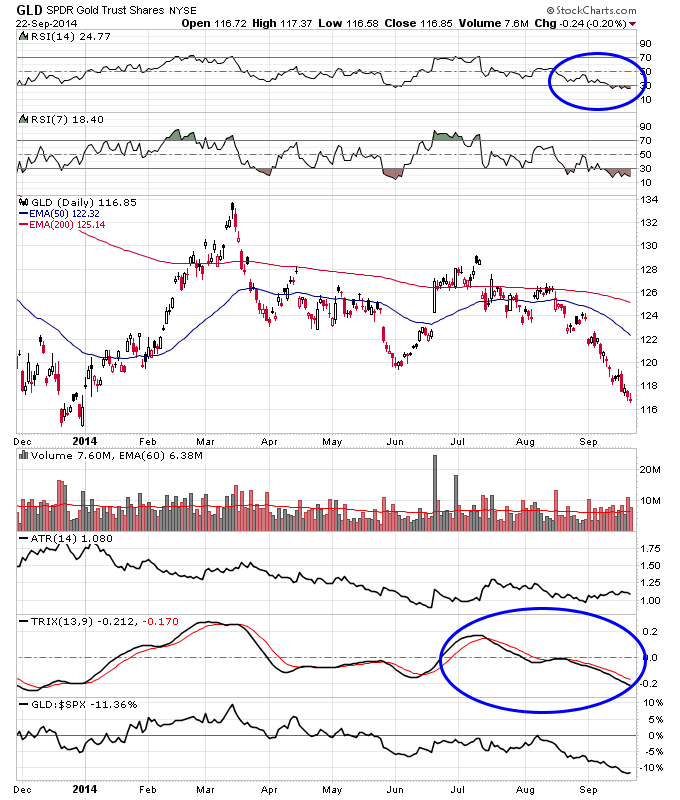

I find it very interesting that gold has gotten this oversold yet has not made a new low for the year or this bear market. Gold is now at its most oversold level for the year just like silver. So again it is likely this bear leg is getting long in the tooth. At the start of October it will be a 3 month long downtrend so it’s overdue on multiple time frames for some type of rally.