Back in 2019 I wrote an article about the big base forming in Chinese stocks and how it was similar to the setup in Biotechnology stocks in 2011. If you study bull markets these big basing formations are what produce massive moves higher when a Stage 2 uptrend starts. Typically at the start of the Stage 2 uptrend only the people closely following the charts are even aware of what is going on, which is where doing your research pays off when these big trends start.

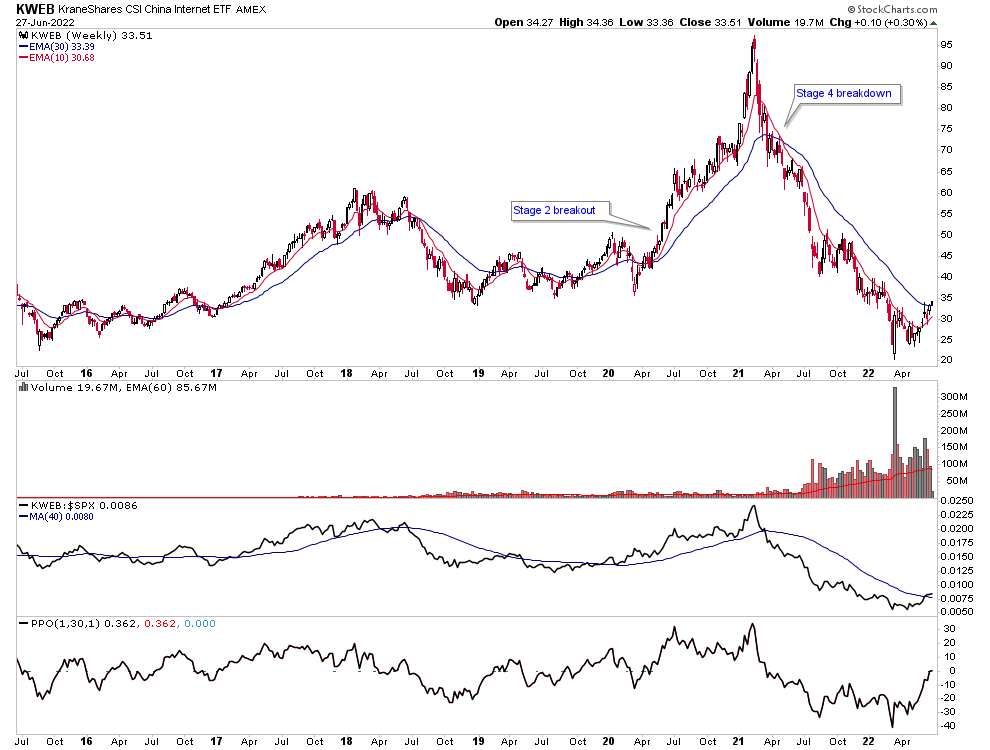

The Chinese stocks did end up finally breaking out in 2020 along with everything else after the March 2020 panic, but they have been hammered again during this recent bear market in 2021-2022. They actually started their Stage 4 downtrend after a parabolic blowoff top in early 2021. This Stage 4 downtrend has been so extreme that Chinese stocks have once again reset their long term base that they have been unable to breakout out from for more than a decade.

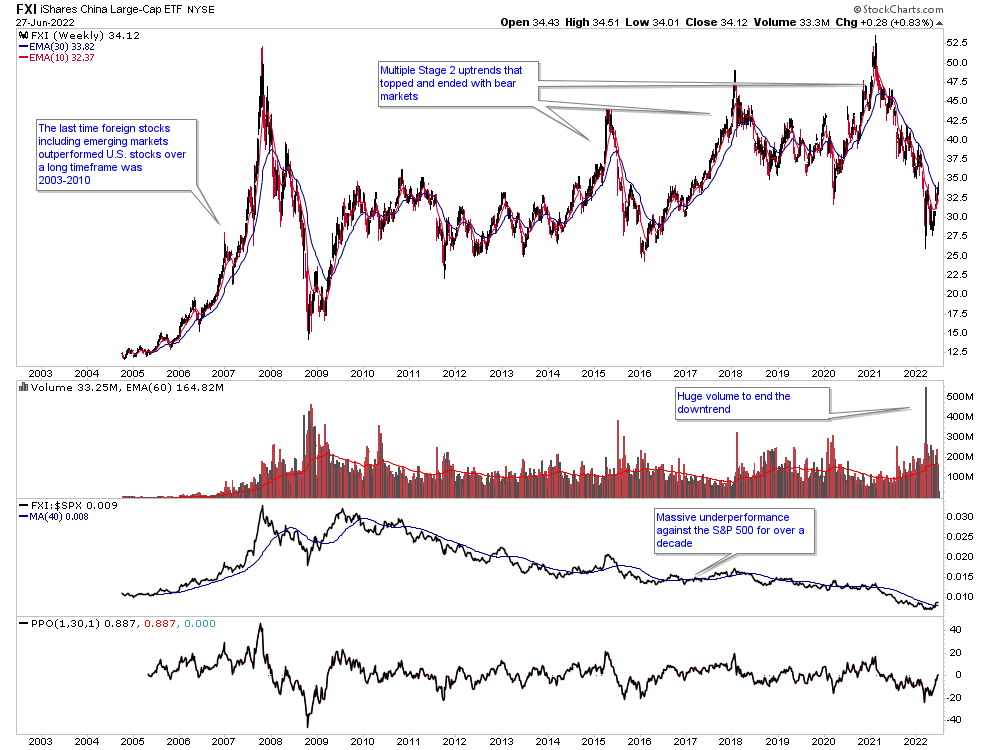

Zooming out on FXI which is a popular large-cap ETF for Chinese stocks you can see that the last time Chinese stocks outperformed the S&P 500 for a significant period of time was from 2005-2010, or more than a decade ago. This time period actually saw Emerging Markets outperforming Developed Markets as well. Since 2010 the relative strength of FXI vs. the S&P 500 has been in a downtrend that hasn’t stopped. Also notice how FXI has made multiple attempts to breakout of this big base that have failed each time. The most recent example in 2021 is the most extreme with a devastating bear market back to the bottom of the range. Notice the massive volume however at the end of the downtrend of over 500 million shares for a week in March 2022. Price has respected this low ever since and we’ll zoom in more on it in the next chart.

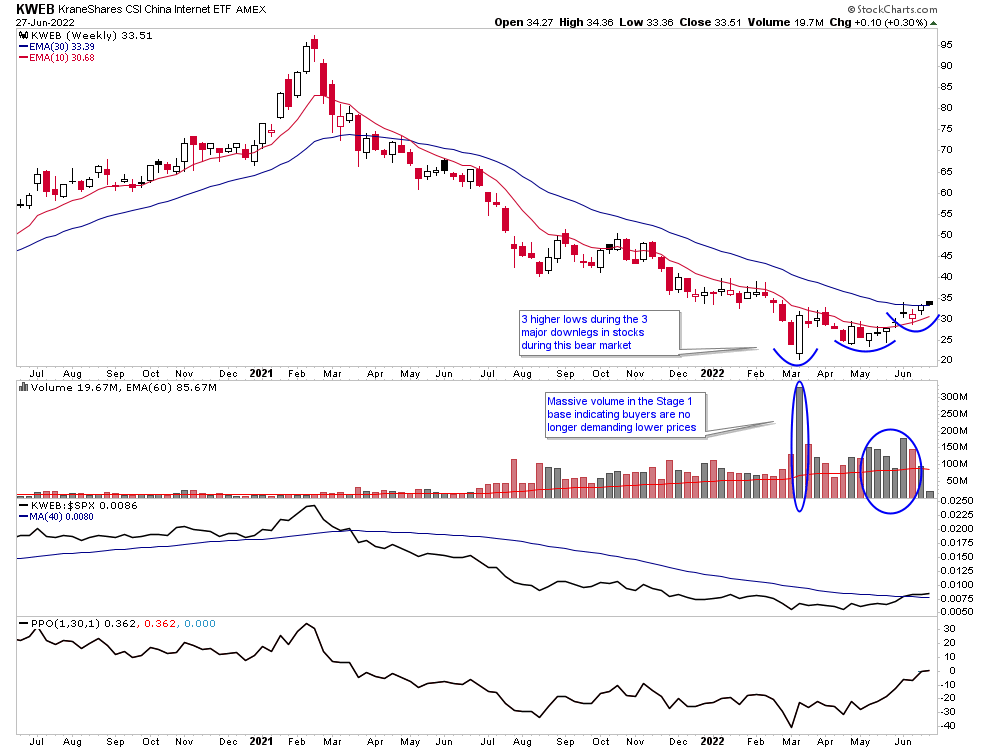

Turning back to KWEB again you can see the massive volume on this chart as well in March 2022. This marked the low for the Stage 4 downtrend and KWEB has made higher lows ever since forming a Stage 1 base. These higher lows are coinciding at the same time as the S&P 500 making lower lows in May and June 2022 which is driving the relative strength of KWEB to start moving higher and starting to outperform the S&P 500. This is typically one of the signals to look for on a Stage 2 breakout but we aren’t quite there yet for KWEB.

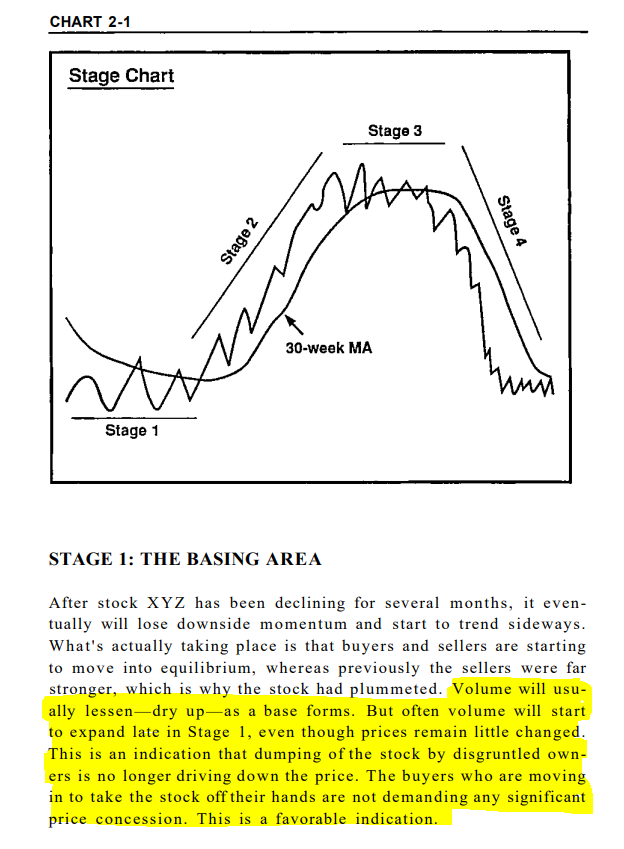

The Stage 1 base in FXI and KWEB isn’t very large so far but the expansion in volume is noteworthy. Big institutions are not demanding lower prices in these major Chinese ETFs even though many other indexes like the S&P 500 are still in Stage 4 downtrends. As Stan Weinstein says below this expansion in volume in Stage 1 can be a bullish indication.

The bottom line is Chinese stocks are once again in Stage 1 and looking for a move into Stage 2 and a new bull market. They are one of the first markets to start basing after the 2022 bear market and are showing a massive expansion of volume in their Stage 1 bases. Leading stocks in the group are also starting to breakout into Stage 2. An even more bullish factor is the monster 10+ year base that is in existence for this group and what it could potentially mean for the upcoming bull market. The potential here is enormous and the massive volume coming into the group could be an early indication of what is coming.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.