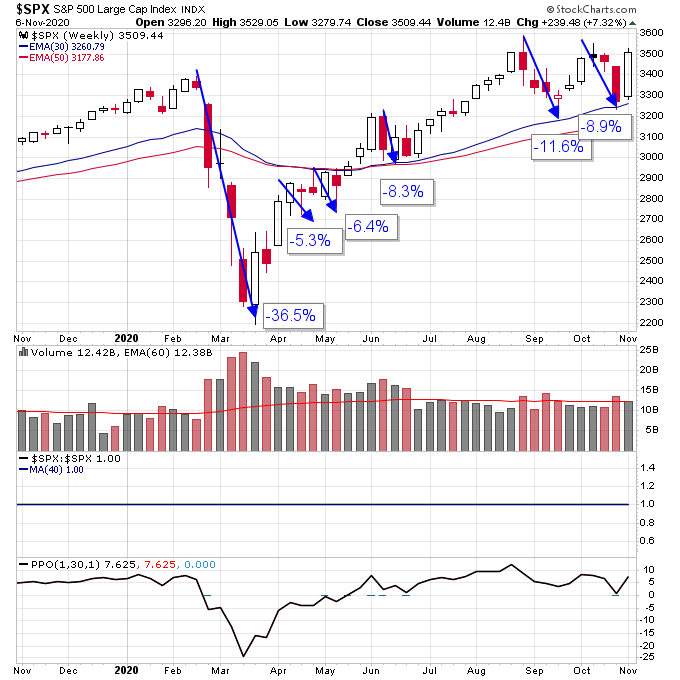

The S&P 500 had one of its biggest weeks of the year last week and this comes off the heels of two nearly -10% pullbacks in both September and October. This corrective period did a lot of damage to many stocks but some of the best stocks held up while the market was correcting.

Besides getting defensive and raising cash during corrections one of the things I do is study relative strength and find stocks that aren’t giving up much ground during the correction. Then when the market turns if these stocks start quickly moving higher on increasing volume and make new highs immediately then you have a good chance of identifying the next big winners during the next upcycle.

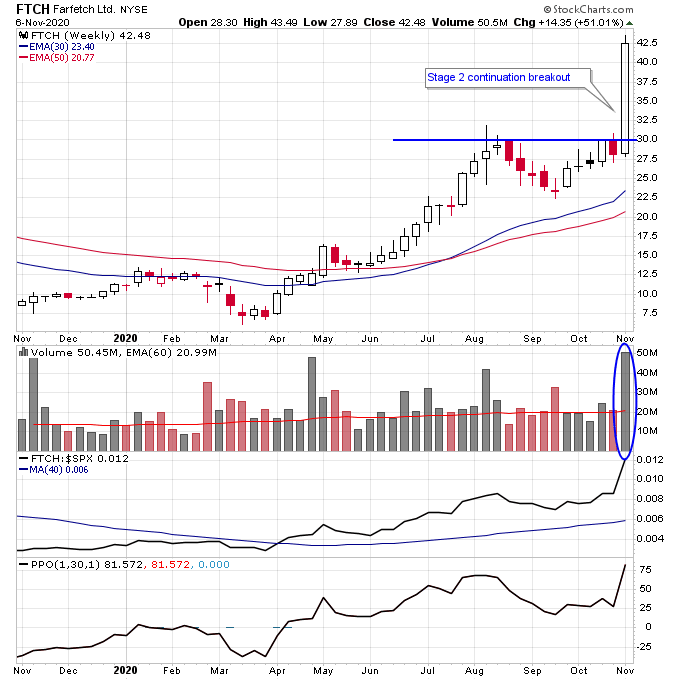

Needless to say last week the market changed dramatically and a slew of stocks completed Stage 2 breakouts on huge volume as buying was relentless for most of the week. This is exactly what you want to see coming out of a correction is impulsive buying and new leadership sectors.

Some of the new leadership that I observed included cannabis, Bitcoin, and Chinese stocks and there was also a renewed explosion in volume in solar stocks. As Stan Weinstein says if multiple sectors are showing strength there’s no reason to trade just one of them, especially early in a new market uptrend where you don’t necessarily know what the true leadership is.

Besides being from strong sectors, 3 stocks I’m highlighting below and what I especially like from each of these stocks is they are breaking out and making new highs with no resistance immediately as the market is coming out of a correction. Stocks with no resistance tend to perform better during an uptrend because they have no sellers looking to get back to even on the way up.

GRWG tried to breakout above $18 and failed twice during October but volume during both of the breakout attempts was solid. Then it ripped higher last week on 2x average volume again and made a new high. Notice how the relative strength against the S&P 500 moved higher during September and October showing how well this stock was holding up during the correction. GRWG is part of the U.S. cannabis sector which had numerous stocks breaking out to new highs last week.

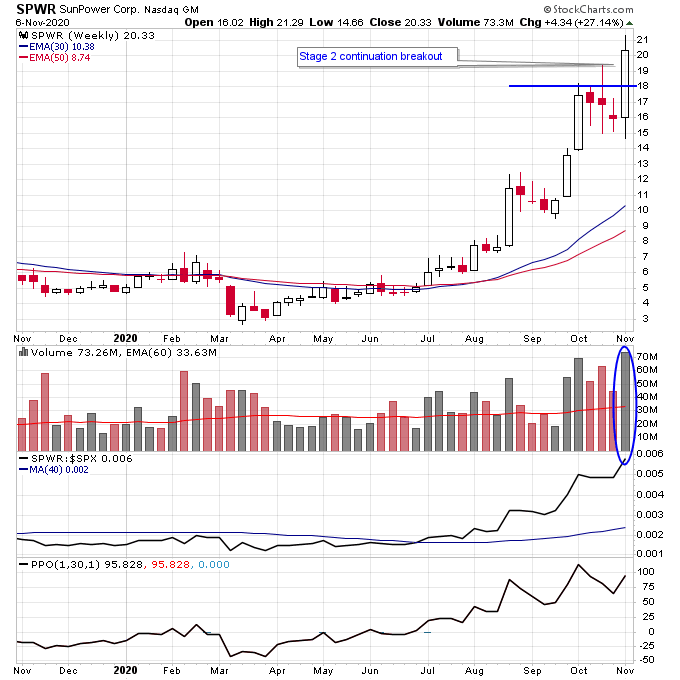

SPWR had a big Stage 2 continuation breakout last week on the biggest weekly volume of the year for this stock. Solar stocks as a group broke out into Stage 2 in July so their Stage 2 uptrend is still not extremely old, but some of the stocks did start selling off on volume before last week. But things changed dramatically last week as the volume that came into the TAN ETF was also a record for 2020. Solar looks like a sector that is going to resume leadership to me based on the action from last week. SPWR also has an extra kicker because it has a massive short position against it that will need to be covered.

FTCH like SPWR had its biggest volume week of the year last week and also is at new highs with no resistance. This Chinese retail stock also has a massive IPO base that it broke out of and big bases are another key ingredient for finding the best Stage 2 breakouts.

Disclosure: I am long GRWG, SPWR, and FTCH.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.