After following this gold bear market from 2011 until now one thing I’ve noticed is that most of the hatred and fear towards gold has occurred in the past year or so. There’s a saying that everyone loves it at the top and hates it at the bottom and I think that applies once again to gold.

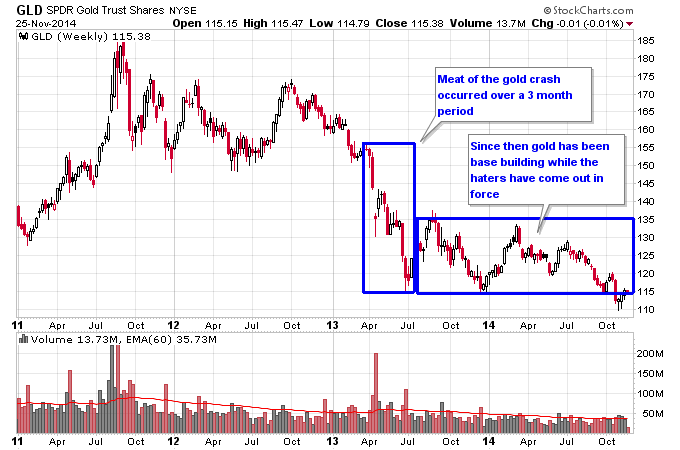

The real crash in gold occurred way back in early 2013, and there were some bears in gold back then but they were only starting to come out of the woodwork. What was essentially the main part of the crash in gold occurred over about a 3-month period from April 2013-June 2013. And ever since then gold has been building a base with a few failed rallies and failed breakdowns.

So in the face of an ever increasing number of bears gold has basically held it’s ground all year. The small speculators in the futures pits have their biggest gold short during this entire gold bull right now too. The bears have their money where their concentrated and pervasive bearish viewpoints lie. But since everyone has capitulated for the most part, gold is having a hard time going down anymore because we’re running out of new bears to keep the selling going.

It’s not abnormal to see a market base for a period of a year or more or even multiple years. It’s not abnormal to have a cyclical bear market last a few years, and it’s not abnormal to have it cut a market in half or more during that time. It’s not abnormal either for everyone to turn bearish at the bottom of a bear market. All of this is normal activity, and occurs over and over in markets.

So the gold market is behaving normally during this bear market even though most of the media and gold permabears would have you believe gold is a broken market that will never come back. In reality gold is just in a bear market that is starting to get old and we should be watching for a new bull market which will be a monster opportunity on the long side.

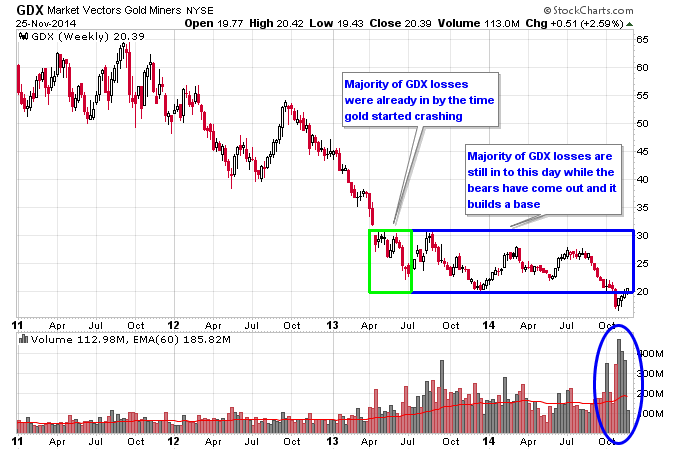

If you take a look at GDX you can see that even during that April 2013-June 2013 crash in gold, the majority of its losses were already made. So GDX fooled the bears even more than GLD completing the big part of its bear market way before everyone turned bearish. Since then GDX has been basing as well, with some more losses along the way but the large portion of the downtrend was completed a while ago.

I also find very interesting the big volume as GDX broke below the base but has now rallied back into it. This type of failed move on big volume is what you see in bottoming activity as the final longs are flushed out which ends the bear market.