2018 was book-ended by two big stock market corrections. The first one was overdue after a big 2017 and a stairway to heaven rally to start 2018. The second one started after leading stocks started faltering in October which is notoriously a volatile month. It turned into an even bigger rout when support on the S&P 500 at 2600 broke through in December.

One of the big differences between how I traded 2017 versus 2018 was that I was heavily in cash often in 2018. This was something that hardly ever happened earlier in my trading career and was why I would get beat up during stock market corrections. This includes both sideways corrections and downward corrections. I did a recent video about this where I talked about how in Stan Weinstein’s book he states that you want to be: “heavily invested in the best acting stocks when the market is powering ahead, and sitting on large cash reserves when the overall trend turns bearish.”

Position sizing is a key ingredient to trading effectively. You want to be aggressive when the market is in Stage 2 and a strong sector is powering higher, and defensive and heavily in cash when the market is in Stage 4 and most stocks are faltering.

The best things I did in 2018:

- Correctly got defensive and raised cash before the drop in early February

- Traded stocks in the leading sectors this year which were software and cannabis

- Traded many Stage 2 breakouts in cannabis stocks well and used the strategy of buying stocks that hadn’t broken out yet in a strong sector to my advantage

- Some of my biggest winners were TEAM and TWTR for tech stocks and ACB, APHA, CGC, and NBEV for cannabis stocks

- Correctly got defensive and raised cash before the October drop and stayed largely defensive through December

- Correctly identified the weakness in foreign stocks and the rollover into Stage 4 of almost all foreign markets as a threat to U.S. markets, which materialized in October 2018

The worst things I did in 2018:

- Buying and holding TEAM after the Stage 2 continuation breakout in 2017 would have produced more profits for me than trading it multiple times. I need to get better at holding some stocks longer

- On the flip-side my worst move of the year was holding onto some cannabis stocks too long when the cannabis stocks topped out in early October

- I traded some stocks poorly taking trades that weren’t good setups such as in the cannabis stocks PYX and DTEA. I let FOMO (fear of missing out) get to me a little bit

- I was too aggressive at the end of the run in cannabis stocks. Just like you should raise cash when the market turns negative, you should be raising cash after a big run and trading smaller. Profit potential eventually runs out in every big move higher

- Even though I went heavily to cash before each market downturn in 2018 I still took some bad trades and lost some money

Goals for 2019:

- One of the things I don’t like about Stage Analysis is there is no mention of selling into strength to lock in profits. I need to work on my trading plan to better define a balance between selling into strength and selling due to a stop loss

- Stick to my system and only take trades that meet the rules of Stage Analysis and my trading plan that uses Stage Analysis as the framework

Overall for 2018 I returned over 23% compared to -6.2% for the S&P 500, and the third year in a row I’ve dramatically outperformed the index.

Forecast for 2019:

First of all forecasts and predictions in the stock market are not helpful. I wrote about that at the end of 2017 and I’m pretty sure no one predicted what ended up happening in 2018. In my view the best approach is to understand the current structure of the market (using Stage Analysis), and then take the market a day at a time and make adjustments as time goes on. This way you can stay “in-sync” with the market and be ready to jump on opportunities when they arise. This Stage 4 downtrend in the S&P 500 is eventually going to produce big opportunities, but we have to be patient and let it play out.

The S&P 500 has two problems right now. It’s in a Stage 4 downtrend, and even if it rallies it has overhead resistance to deal with. Since the S&P 500 is still very oversold I do think it is likely that it moves back higher in the near term to re-test the 260 level on SPY. But after that we will need to see how leading stocks and other markets are acting to determine whether we have hit the bottom or not.

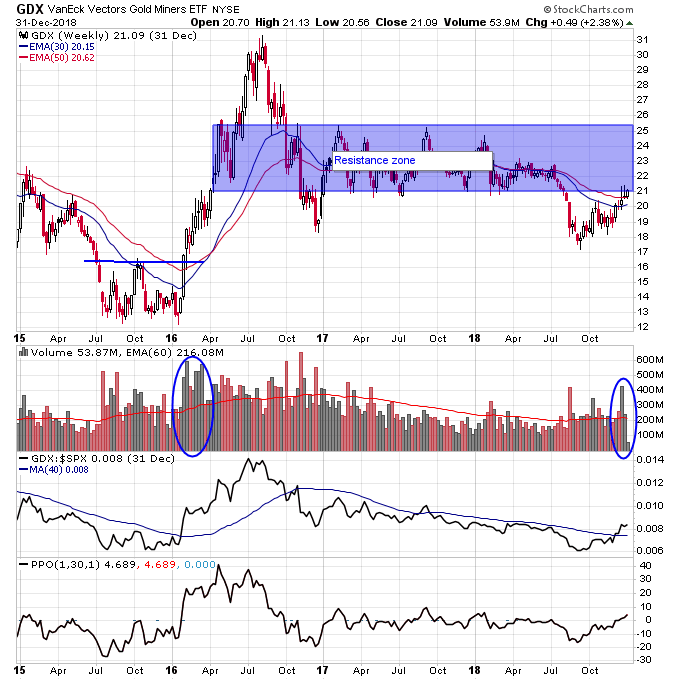

Besides bonds which have broken out into Stage 2 the gold market is still flirting with a Stage 2 breakout. The one thing that is missing from the charts of most gold miners is a big increase in volume. As most traders come back from the holidays I’m going to continue to pay close attention to the gold miners as 2019 starts. For GDX shown below I want to see sustainable increase in trading volume and a break above the resistance zone from 21-25. Along with that we should see individual gold mining stocks breaking out on volume to confirm a real Stage 2 move and not a fake rally.

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Check out my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.