The market has had an impressive run since the start of the year, but one sector that has lagged is the commodities sector. Unlike general stocks, commodities are still quite a ways away from their 2011 highs. Recession fears and a surging dollar contributed to the weakness in commodities last year. But a number of factors are starting to show the tide potentially turning for the commodities sector going forward in 2012.

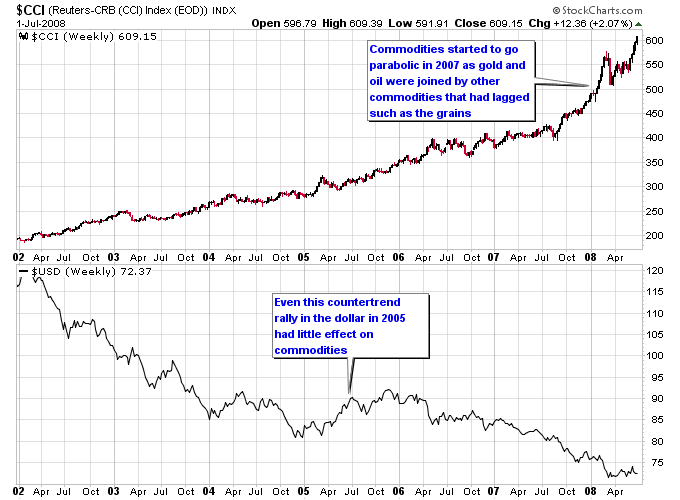

In the first leg of the secular bull market in commodities that started in 2002, commodities more or less enjoyed a steady grind higher. They were helped along by a bear market in the dollar. Countertrend rallies in the dollar had little effect on commodities during this period, most notably in 2005 where the dollar rallied for most of the year. In 2007 commodities started to accelerate higher as more individual commodities started joining the overall commodities rally. This included the grains sector which until 2007 hadn’t enjoyed the gains other commodities such as gold and oil had achieved. All of this culminated in a peak in the CCI commodities index in 2008 as it accelerated into a parabolic move in March, underwent a correction, then made a final top in the summer of 2008.

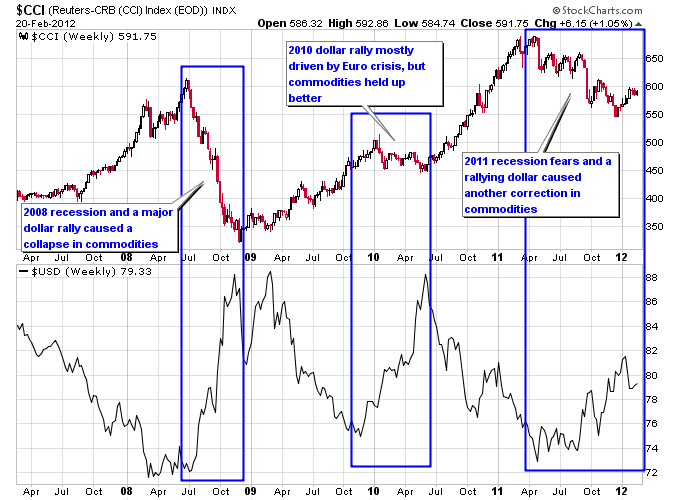

Then came the stock market panic in mid to late 2008. From the onset of the panic and ever since, commodities have acted much differently than they did during the previous 6 years leading up to the panic. They have had two major swings to the downside, along with a mini correction in 2010. All three corrections were in large part caused by three major dollar rallies that have occurred since 2008, shown on the chart below.

The primary driver of the last two dollar rallies has been a collapsing Euro. The first Euro crisis, which seems like forever ago, actually caused a much more severe correction in the Euro than this latest Euro crisis. But what is interesting is a similar setup to the end of the first Euro crisis is occurring again. This of course would be bullish for commodities since it would imply a near term end to the rallying dollar.

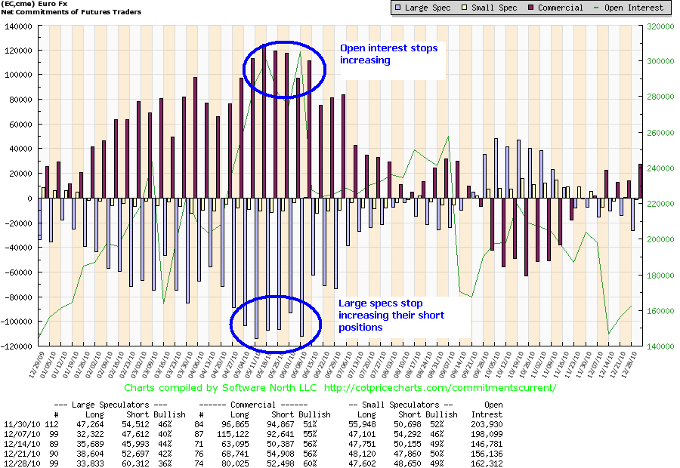

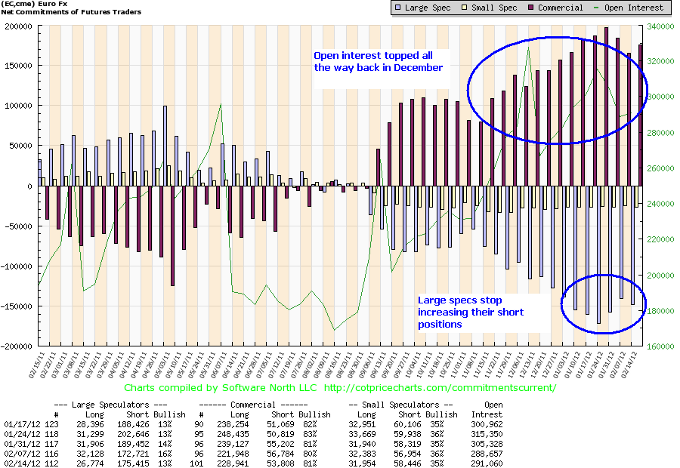

The next few charts show how the Euro is positioned in a similar manner now to what is was doing back in 2010 when it bottomed. First, taking a look at Euro futures positions, back in May 2010 large speculators finally stopped adding to their short positions in the Euro after a 6-month downward move. Open interest also leveled off, which indicated a possible trend reversal.

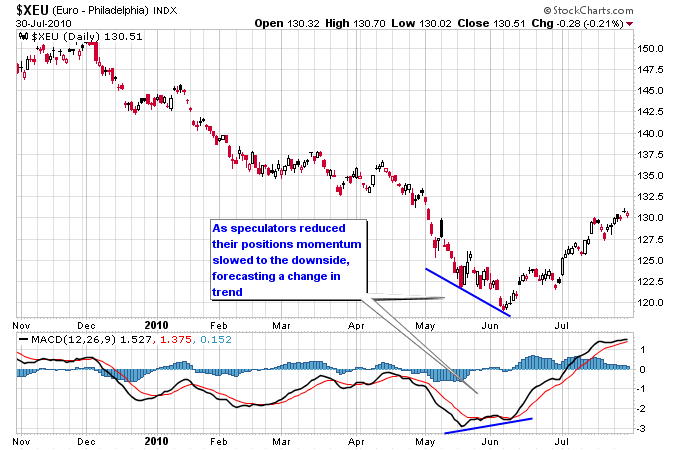

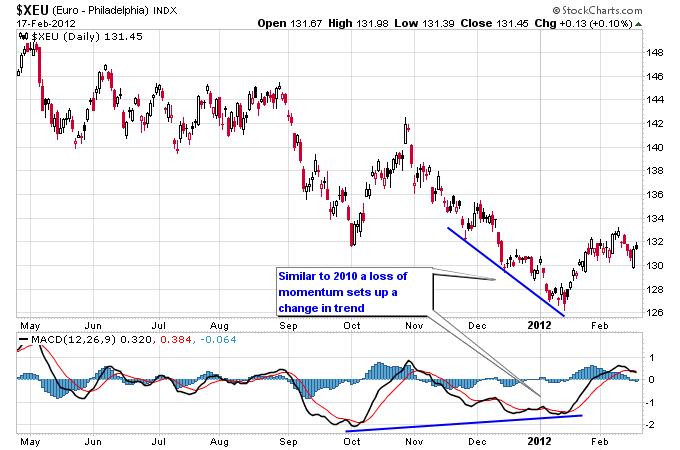

On the chart below you can see how this leveling off in speculative activity helped confirm the final bottom in the Euro. Note the divergence in price and momentum in May and early June.

Now moving to the current situation for the Euro, you can see a similar leveling off in the addition of positions in the futures market. Open interest also topped way back in December. It’s interesting to note that there was more speculative activity in Euro futures during this latest move in the Euro, but the overall move wasn’t as significant as the first Euro crisis.

Again, a similar divergence in momentum and price led to a change of trend for the Euro in January. So far this change in trend has held up.

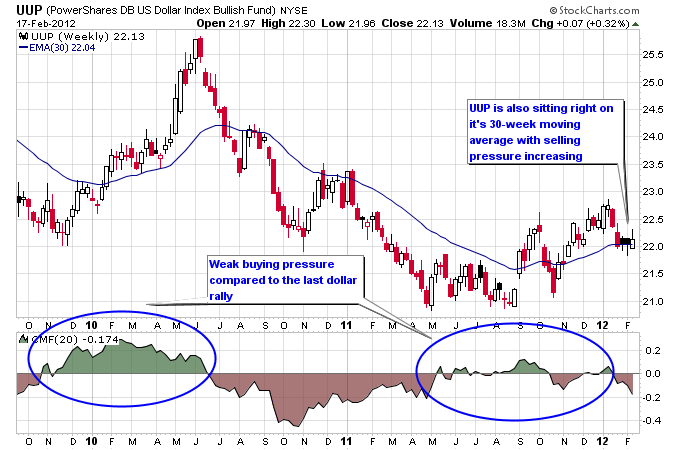

Money flows into the bullish dollar ETF UUP also were dramatically lower than they were during the last major dollar rally as shown in the next chart. And selling pressure has started to accelerate over the last month.

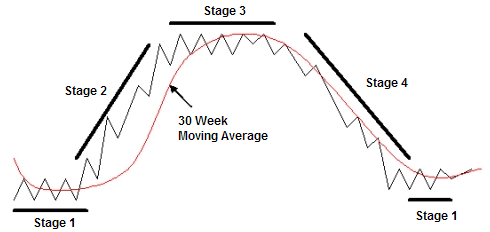

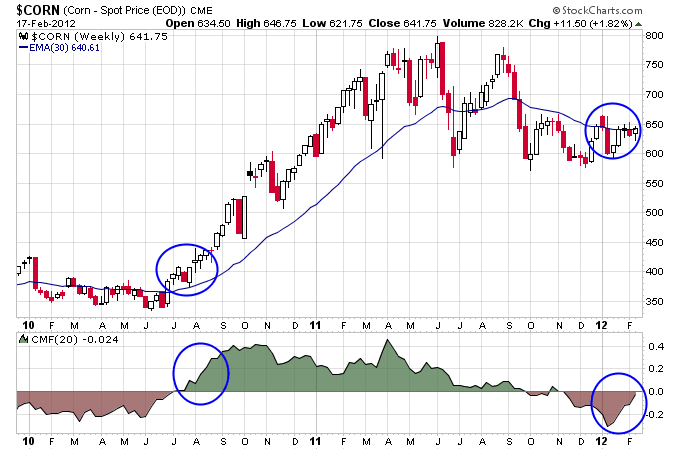

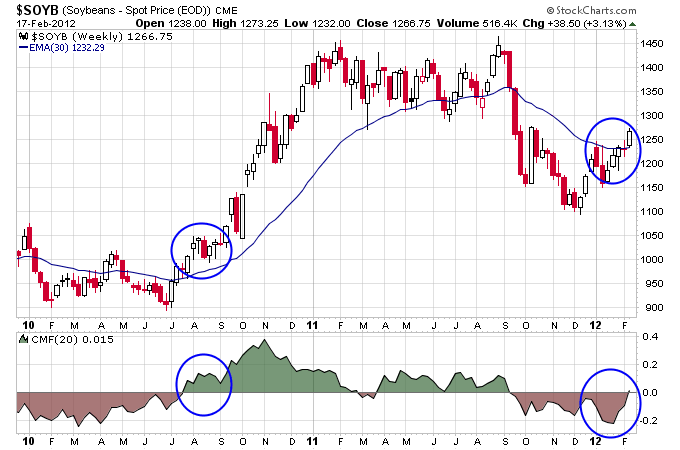

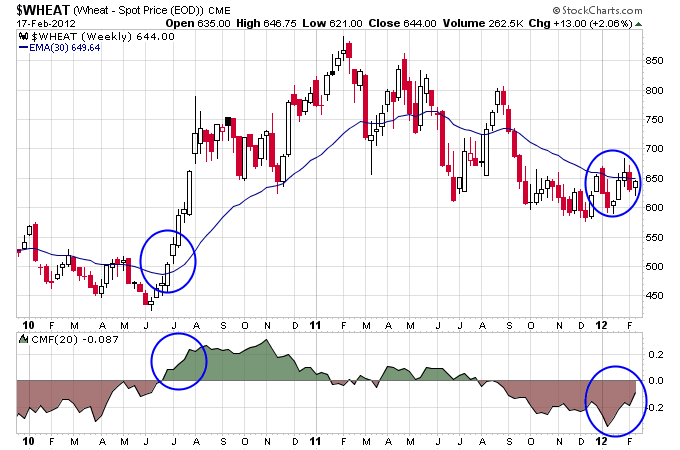

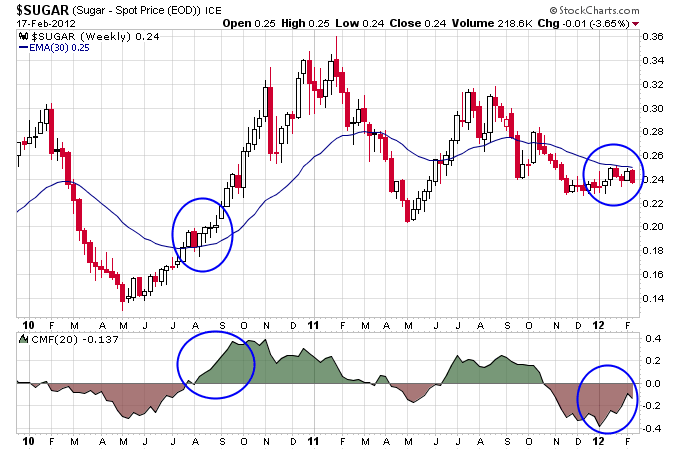

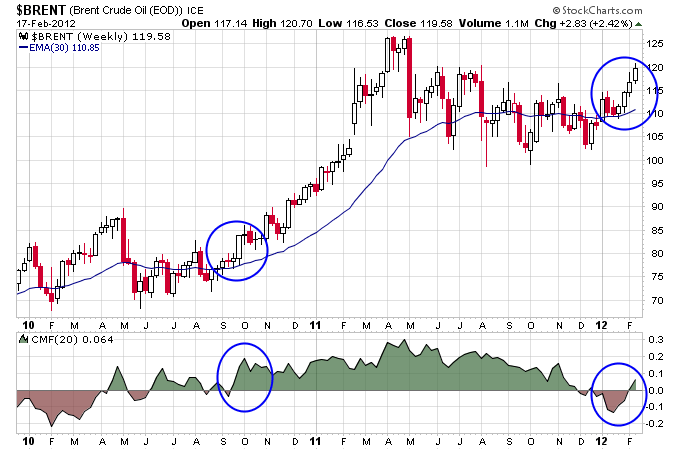

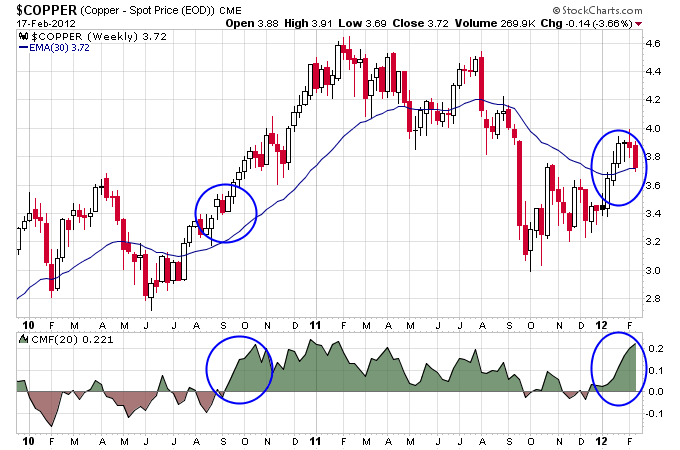

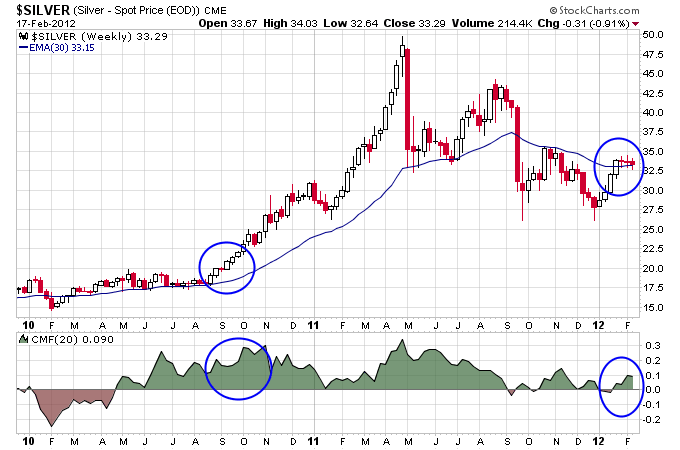

Finally, from a Stage Analysis perspective commodities are starting to line up into a potential Stage 2 breakout. On the weekly charts of individual commodities many of them are starting to move back above their 30-week moving average. Some of the money flows are moving back from negative to positive such as the grains sector while other commodities like oil and precious metals are showing increased positive money flow. For comparison purposes, it will be important to monitor how this move compares to 2010 which proved to be a significant breakout to the upside for commodities. Continue to watch the trend in price action along with increased volume for confirmation.

Follow me on Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.