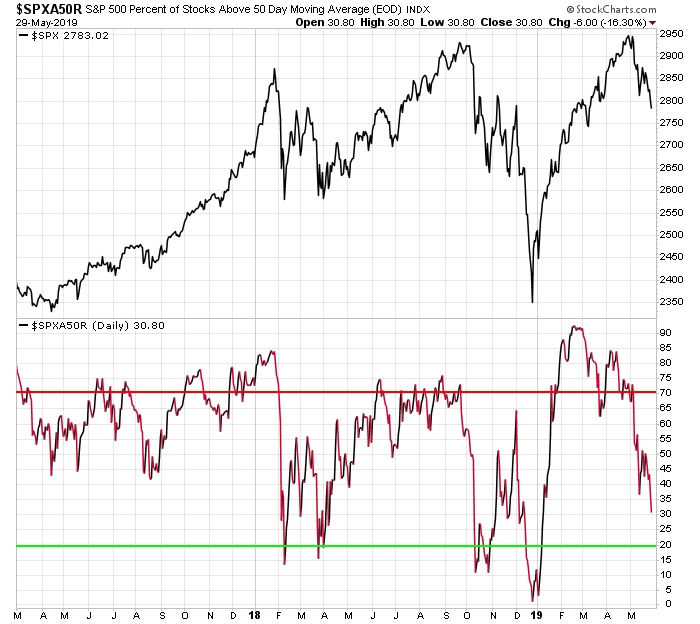

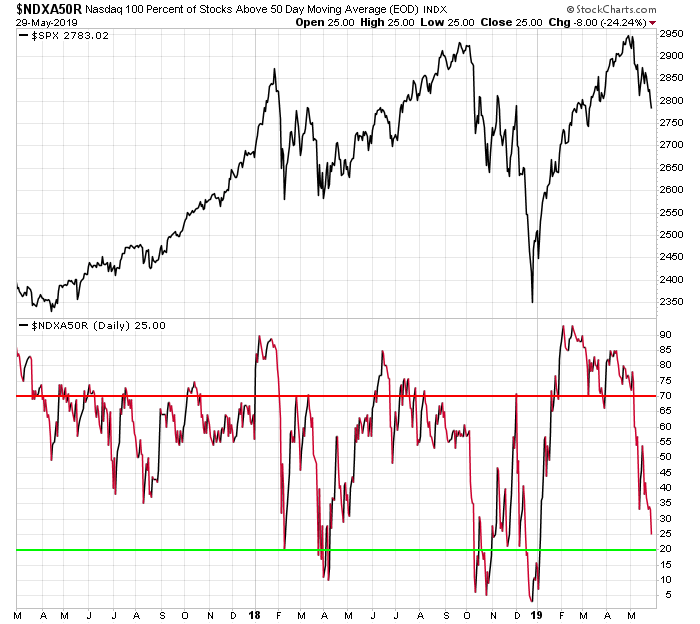

The S&P 500 tends to put in a -5% correction or more 2 to 3 times a year. When that happens the percentage of stocks above the 50-day moving average dips below 20%. These provide the best dip-buying opportunities for the overall market for the year, unless the market is in a bear market.

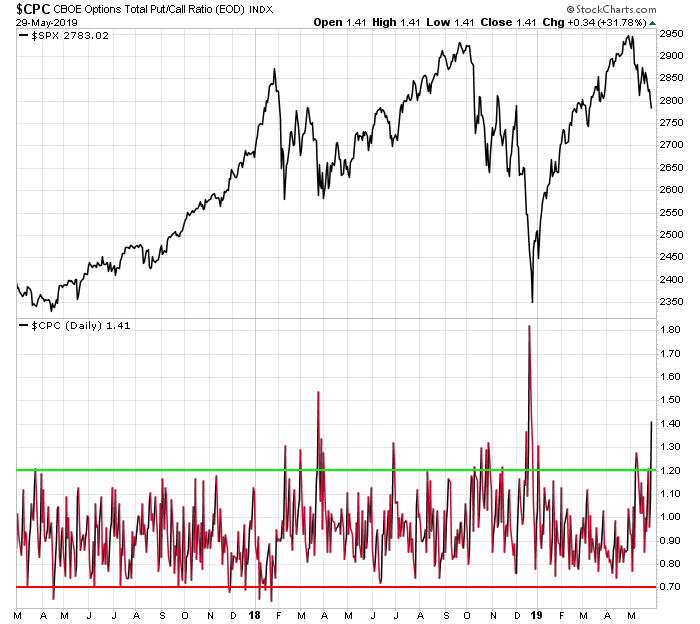

Even if the market is in a bear market, the market tends to bounce to at least 50-60% of stocks above the 50-day moving average before putting in the next major downleg. So the bottom line is that the market is due to bounce here sometime soon. The put to call ratio also is at an elevated level that has marked past bottoms.

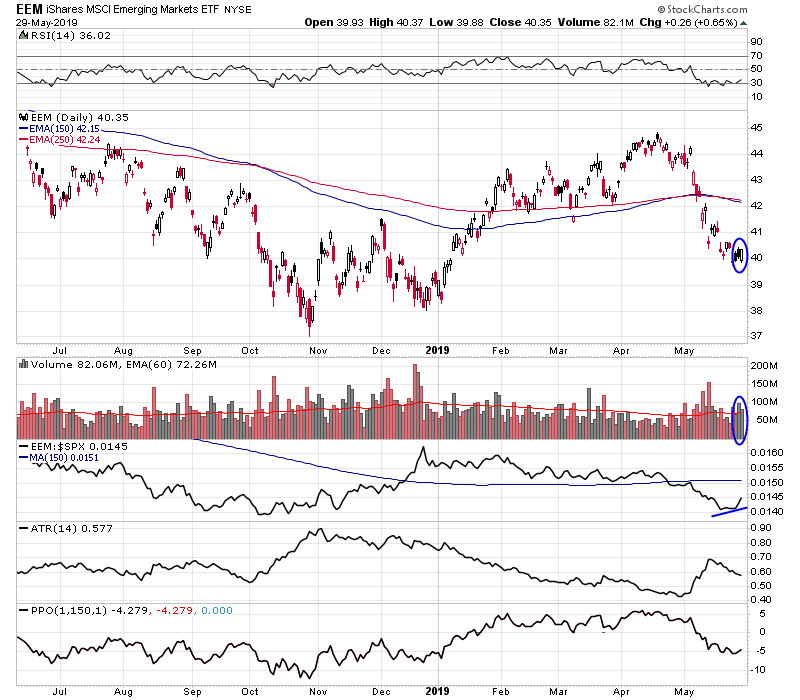

Finally and interestingly EEM closed at the high of the day today and continues to outperform the S&P 500.

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Check out my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.