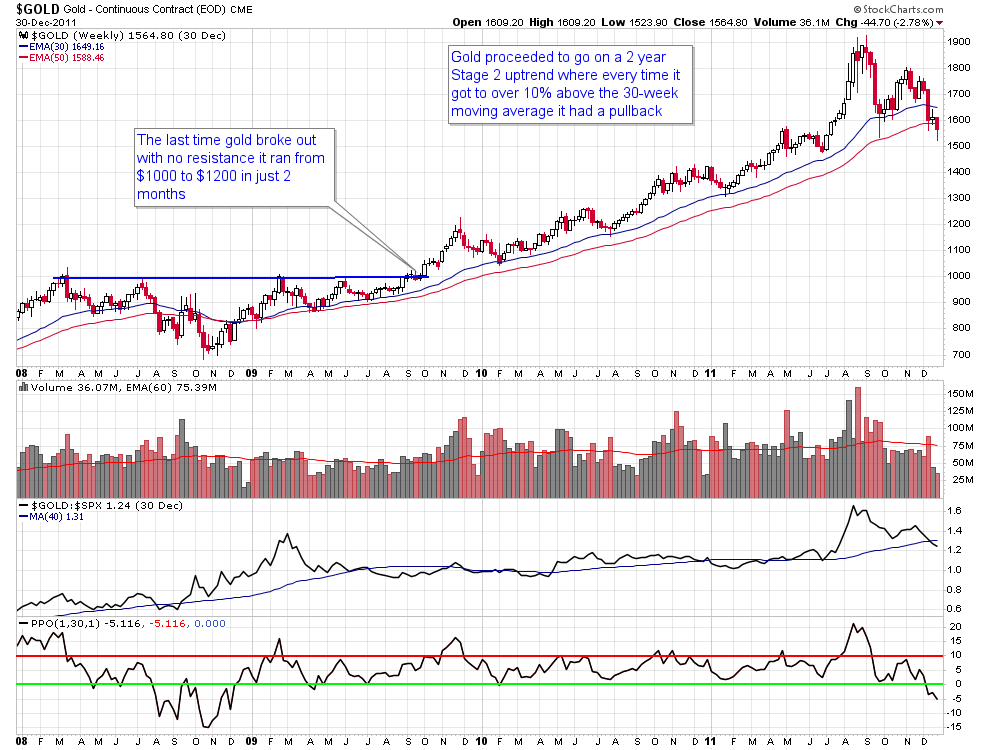

The last time gold broke out with no resistance above it was back in 2009 when it emerged from a multi-year base and ran from $1000 to $1200 in just 2 months. Then it proceeded to go on a 2-year bull market run where it trended above the 30-week moving average and pulled back every time it got around 10% above the moving average. The uptrend ended with a blow-off move above $1900 in 2011.

A lot of people are going to be predicting price targets and duration for the current breakout in gold. I think this is entirely unnecessary, counterproductive, and prone to error because it’s impossible to predict. Instead I think it’s important to recognize the following:

- Gold will likely have rapid moves higher followed by consolidation periods

- Gold will only get so far above the 30-week moving average before it has a correction

- The Stage 2 uptrend could end at any time. The end of the 2016 uptrend in gold for example caught a lot of people off guard and those that held on lost their profits

- A blow-off move usually signals and end to an uptrend

Personally, I like to take partial profits on the way up, especially when markets get extended from the 30-week moving average. That way I have cash to take advantage of pullbacks, and I’m not fully exposed to a market that is making it’s final top.

I’m probably going to have a lot more to say about gold and silver as this move continues so stay tuned!

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.