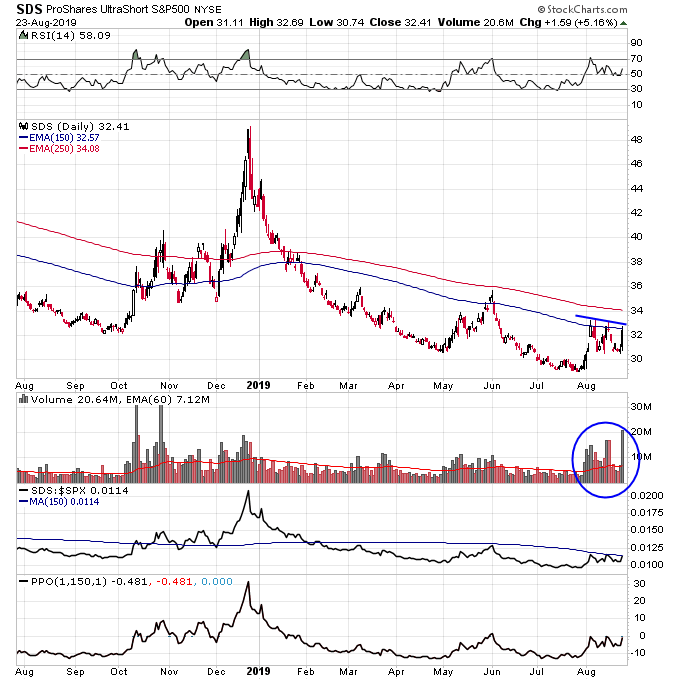

Friday saw the biggest daily volume come into the SDS inverse S&P 500 ETF for the year. This ETF is one of the top bear ETFs for betting against the S&P 500. The volume on Friday is similar in size to what we saw in the fall of 2018 when institutions piled into this ETF as the markets melted down.

This wasn’t the only bear ETF to see significant volume on Friday and could be signalling that the markets are ready to breakdown here. Many leading stocks I follow still held up fairly well on Friday but that could change quickly if the S&P 500 continues to breakdown.

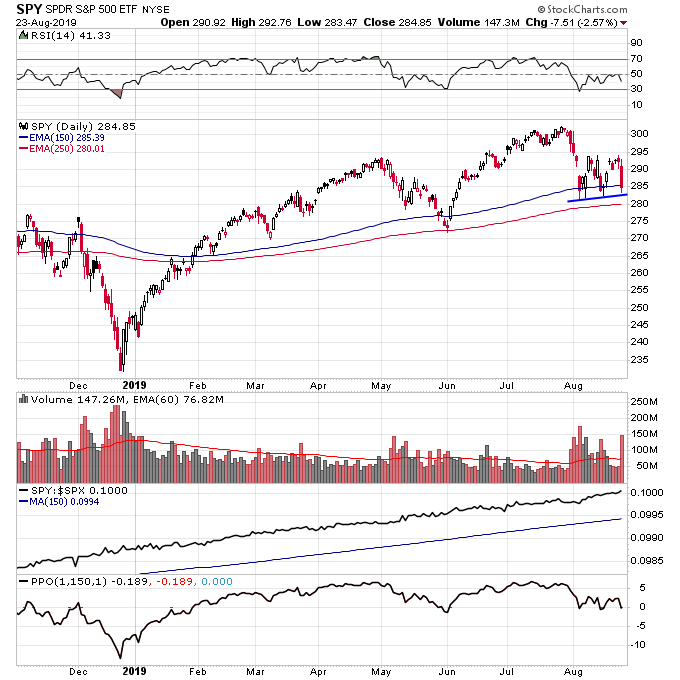

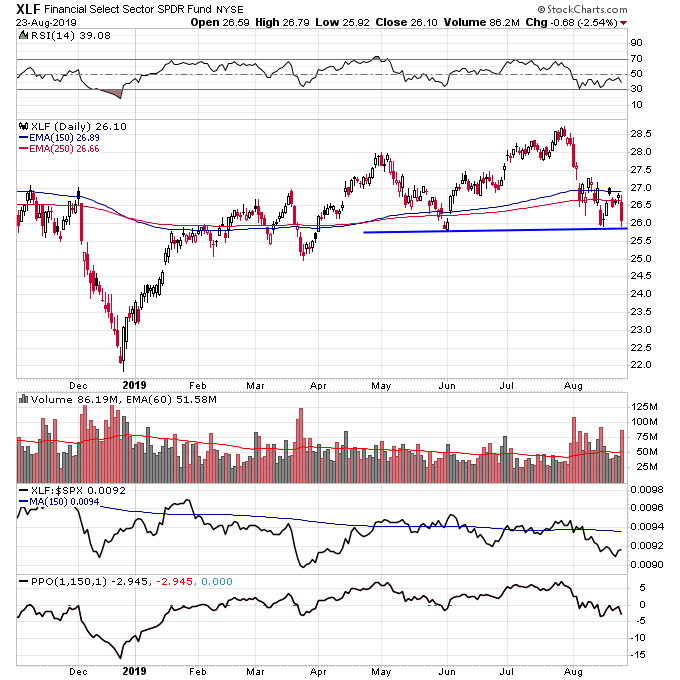

Below the 280 level on SPY the S&P 500 will start to move into Stage 3 and will provide more of a headwind to leading stocks. The same goes for XLF which is sitting right on support at 26 that needs to hold for the market to remain constructive for long trades.

Fortunately gold and silver are still acting well and if the market breaks down here then the appropriate course of action would be to focus on what is working and wait for the market to find a bottom.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.