2021 ironically 10 years later has shown a striking similarity to 2011 as it has been another sideways, rangebound market. Both of these years were coming off of big winning years after major corrections. In 2011 the market was coming off of two strong years in 2009 and 2010 after the 2008 financial panic bear market. In 2021 the market was coming off of the exceptionally strong 2020 market that followed the coronavirus panic in 2020.

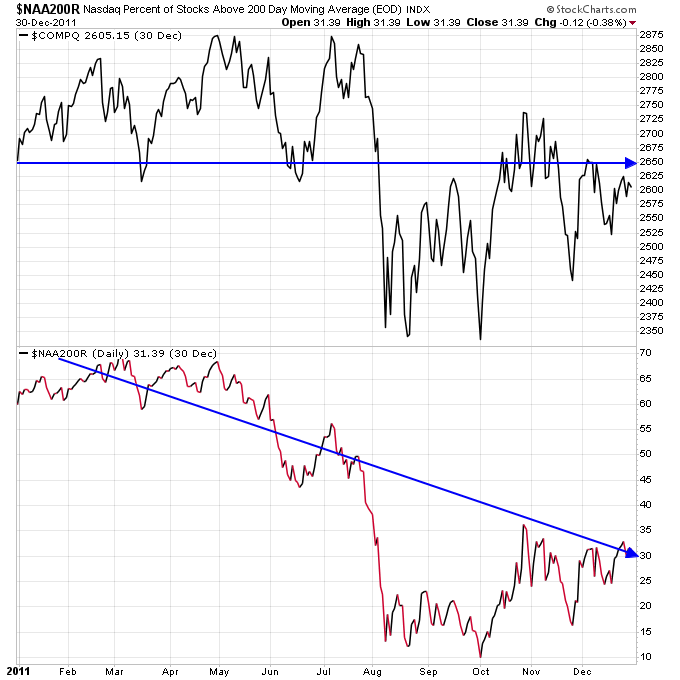

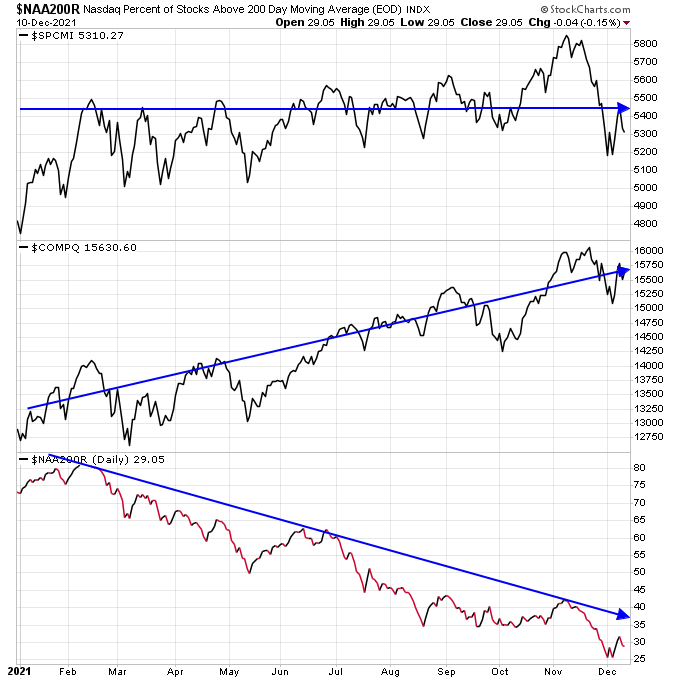

Deteriorating breadth was a major contributor to both weak markets. As shown in the charts below the percentage of stocks above the 200 day moving average (bottom of the chart) in the Nasdaq declined throughout the year.

The difference in 2021 vs. 2011 is that larger cap stocks were able to hold up the major indexes as shown in the second chart where the Nasdaq in 2021 is higher on the year vs. going sideways in 2011. But if you notice the S&P 500 Completion Index SPCMI which excludes the top 500 stocks from the index has gone sideways in 2021 just like the overall market in 2011. So excluding the effect of the largest stocks there’s simply been choppy action in the stock market.

In a sideways overall stock market the best stocks can rally but the pressure of the overall market stunts their growth. And the worst stocks don’t have the support of the overall market at their back so they can fall dramatically. Stan Weinstein emphasizes that the probabilities of success are lower when the overall market isn’t a tailwind.

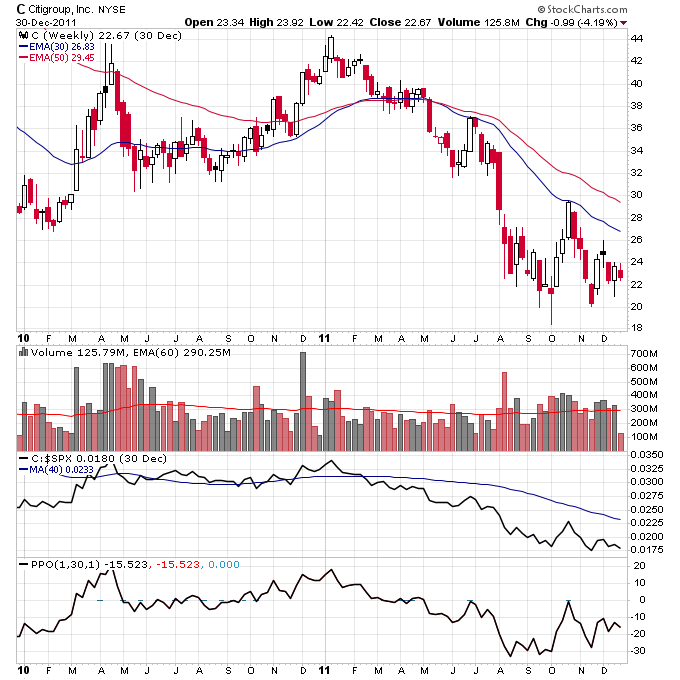

An example in 2011 of a weak overall market wreaking havoc was the bank stocks which rallied after the financial panic but had big Stage 4 declines in 2011.

In 2021 many growth stocks that were big winners in 2020 have moved from Stage 3 into Stage 4 and been hit hard. Peloton was a stock I did a lengthy analysis of on Twitter and it rolled over into Stage 4 this year and experienced a big decline.

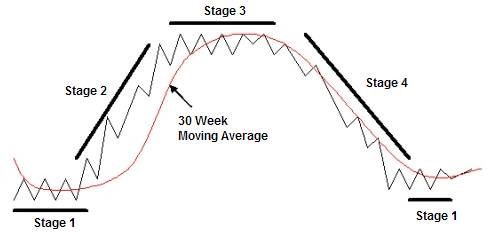

In Stage Analysis when the market is in a sideways, rangebound market after a Stage 2 rally this is known as Stage 3 where the market digests the previous rally and sets up its next move. From Stage 3 the market can either break back into Stage 2, or breakdown and move into a Stage 4 decline. In 2011 the market broke out into Stage 2 again in January 2012.

One of the best things to do during a tough market is study relative strength. The best acting groups and stocks in those groups during a correction tend to lead the market higher once the correction is over. Since sideways Stage 3 markets can last for multiple months you can look for groups and stocks in those groups that outperform the S&P 500 during the same time period.

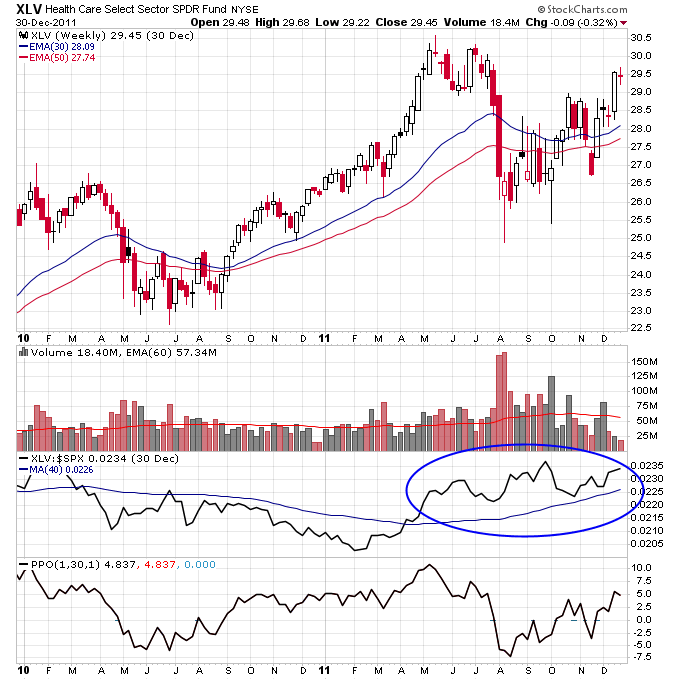

One group that showed a lot of relative strength against the S&P 500 in 2011 was Health Care. Shown below is XLV which outperformed the S&P 500 during all of 2011 from May onward (see circled area in chart). Notice how XLV tried to breakout in May 2011 but the pressure from the general market stalled this breakout and it moved back down. This early sign of strength was simply put on hold while the correction in the market needed time to play out.

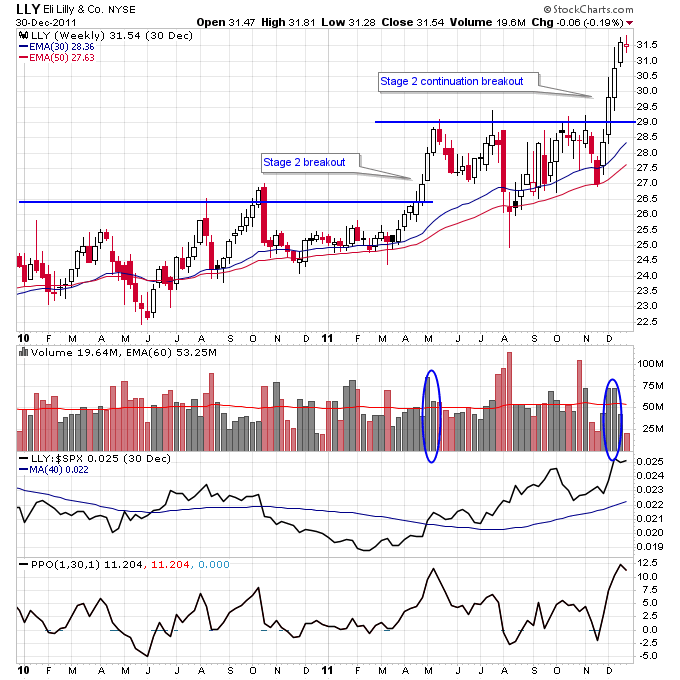

Once the pressure on the general market lifted one of the leading stocks in the Health Care group was LLY which completed a Stage 2 continuation breakout in December 2011. This stock showed early strength just like the health care group earlier in the year trying to breakout into Stage 2 but then it consolidated sideways for multiple months after the breakout due to pressure from the overall market. Once this pressure was lifted this stock started to take off to the upside.

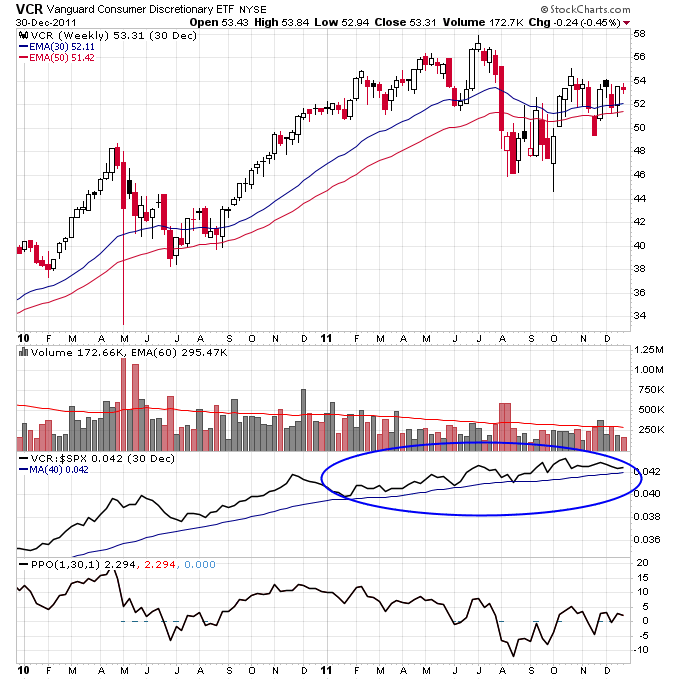

Consumer discretionary also showed tremendous relative strength in 2011 as show by the chart of VCR below (relative strength noted in the blue circle).

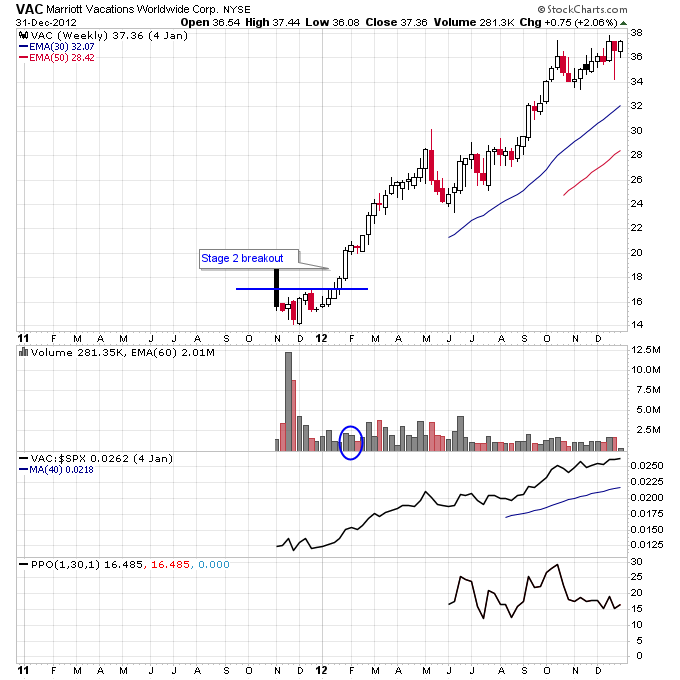

VAC was a big winning stock in 2012. As shown on the next chart it broke out of an IPO base in early 2012 and made a monster Stage 2 advance.

Since VAC was a new IPO it had no resistance to fight through on the move higher unlike other stocks who were pushed lower during the sideways 2011 market. This is another reason its important to keep track of new merchandise that hits the market because these stocks can emerge from IPO bases with no resistance. Limited or no resistance on a breakout is one of the attributes of a high quality Stage 2 breakout.

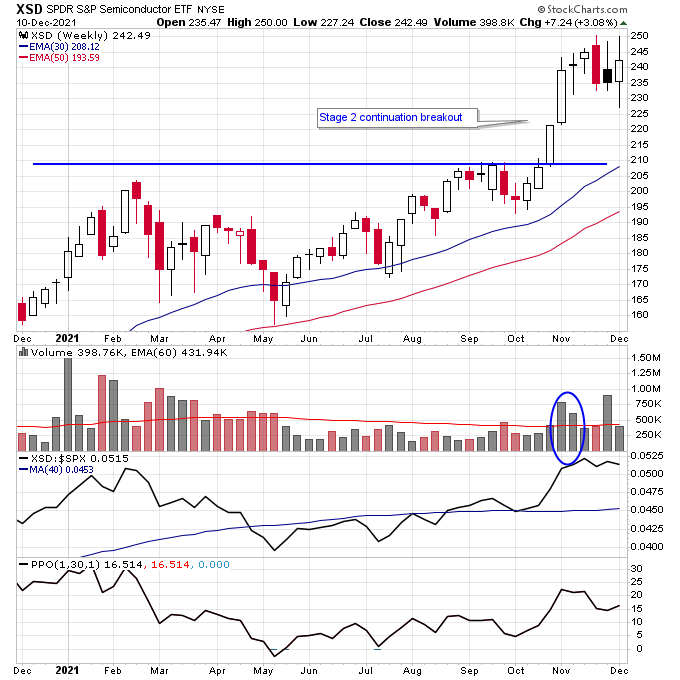

In December 2021 the market is still working through this corrective market but recently multiple groups have started exhibiting relative strength against the rest of the market and a number of high quality Stage 2 breakouts have occurred. XSD below is a semiconductor ETF that completed a Stage 2 continuation breakout in early November and has consolidated nicely under downward pressure from the market specifically in early December.

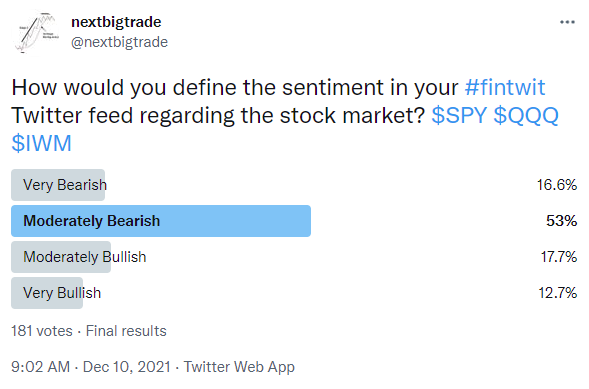

Other groups exhibiting relative strength include Homebuilders (ITB) and Oil and Gas stocks (XLE). Sentiment also appears to be poor (which isn’t surprising given the amount of carnage in many stocks). A recent survey I ran had 70% of respondents describe the sentiment on their own Twitter feeds as very or moderately bearish.

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Check out my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.