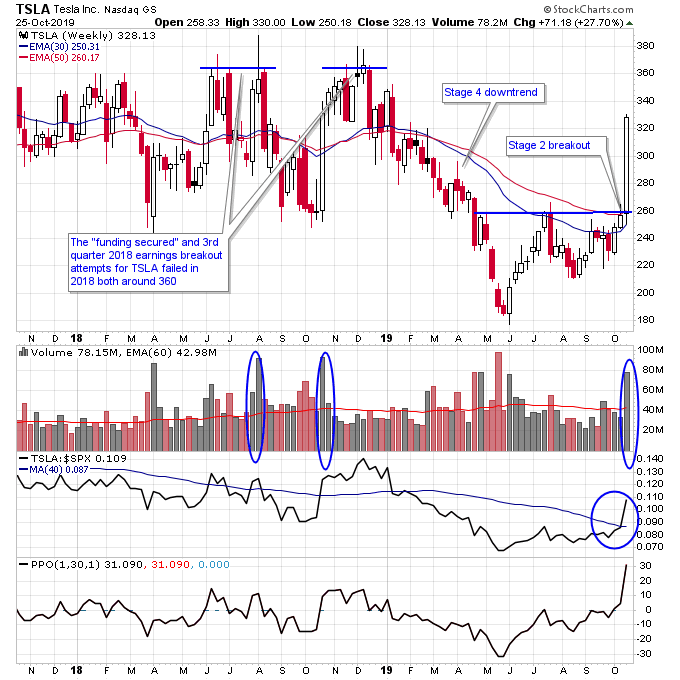

TSLA is a polarizing stock with a lot of strong opinions on either sides, but in this article let’s take a look at the stock from a Stage Analysis perspective. In 2018 TSLA tried twice to breakout above the 360 level into a new uptrend. The first time was during the “funding secured” drama, and the stock had a sizable increase of volume on the breakout attempt but it ultimately failed.

The second attempt to breakout above 360 happened after the 3rd quarter earnings report but this occurred at a time when the overall market was extremely weak so the stock had a bad general market as a major headwind. When the second rally failed TSLA then went into a Stage 4 downtrend which established a bottom in May of 2019.

Then last week after earnings TSLA surged on back to back days of 30 million shares in volume, breaking above it’s Stage 1 base resistance and putting TSLA back in a Stage 2 uptrend. Obviously the one downside to TSLA on the weekly chart is the fact that it still has resistance in the 340-360 range from 2018. It would be more ideal if TSLA had built a larger Stage 1 base and worked off that resistance through time before breaking out.

The volume on the Stage 2 breakout though was extremely powerful, it shows that institutions were aggressively buying into the stock off of the earnings report. It will be important to see if this volume surge continues this week and if it does then it will further add to the case that TSLA is finally back in an uptrend.

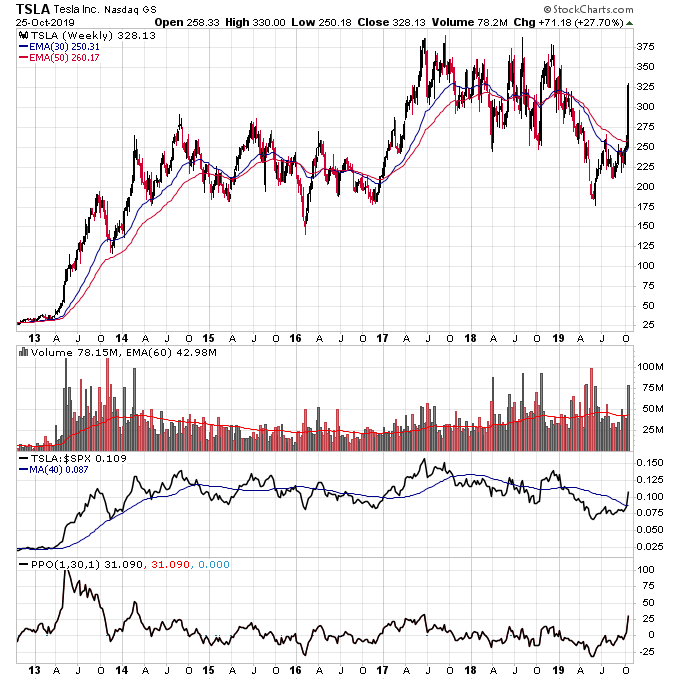

This ties in the final point about TSLA stock that I believe is a good reason TSLA could have a lot of room to run here is that TSLA really has gone nowhere since the 2013 Stage 2 breakout in which the stock made a monster move into 2014. The price of the stock is still virtually the same as where it peaked out in 2014. This sideways price action is what can produce a big move in a stock which is exactly what we’ve seen recently in the gold and silver stocks.

Disclosure: I am long TSLA.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Checkout my trading videos on Youtube

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.