After the coronavirus panic last week the sectors below are standing out as leadership sectors in the stock market. As Stan Weinstein says the importance of selecting stocks in the most bullish sectors cannot be overemphasized: picking stocks from strong sectors can tremendously enhance your returns while stocks in a lagging sector can dramatically underperform.

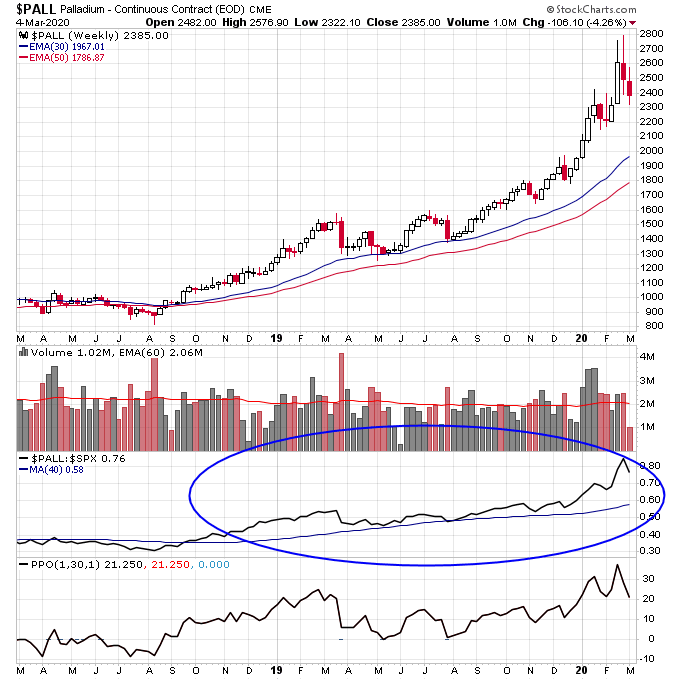

The first sector is one that almost no one is talking about or cares about: palladium. Palladium is the precious metal that gets the least respect but by a wide margin it has outperformed gold, silver, and platinum over the past few years. Palladium has been in Stage 2 since September 2018 and has been outperforming the S&P 500 since then. Overall in 2020 even after the coronavirus panic palladium is up more than 20%.

The solar sector has been in Stage 2 since early 2019 as shown below by the ETF TAN. Solar has had some tremendous Stage 2 winners recently such as ENPH and SEDG. Notice how like palladium the TAN ETF is still well above the 30-week moving average and close to a new high after the panic. This shows that solar stocks were in much stronger hands during the panic than other sectors in the market.

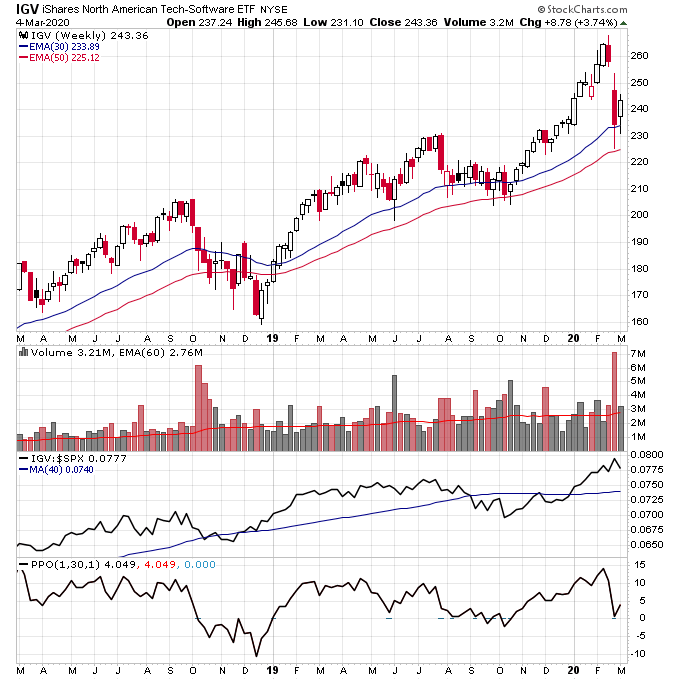

Finally software has been a leading sector for years now, and the IGV ETF held the 30-week moving average after the panic last week. Software has benefited from a high number of successful IPOs that have debuted over the past few years and continue to debut. The former resistance level at 230 on the IGV ETF held as support so far along with the 30-week moving average.

The key thing to realize about the sectors above is that stocks in these sectors will likely have less resistance to fight through if the Stage 2 uptrend resumes after the recent panic. Stocks that are able to make new highs quickly after a correction are often the next leading stocks in the market, so it is important to pay attention to what holds up the best whenever the stock market has a correction.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.