- Last week we witnessed a rare event in the markets where we literally went from a new high the previous week immediately into a full-blown panic.

- We were overdue for a pull-back in the markets and this fact along with a sudden spike in Coronavirus fear in the U.S. added fuel to the fire and ignited a panic.

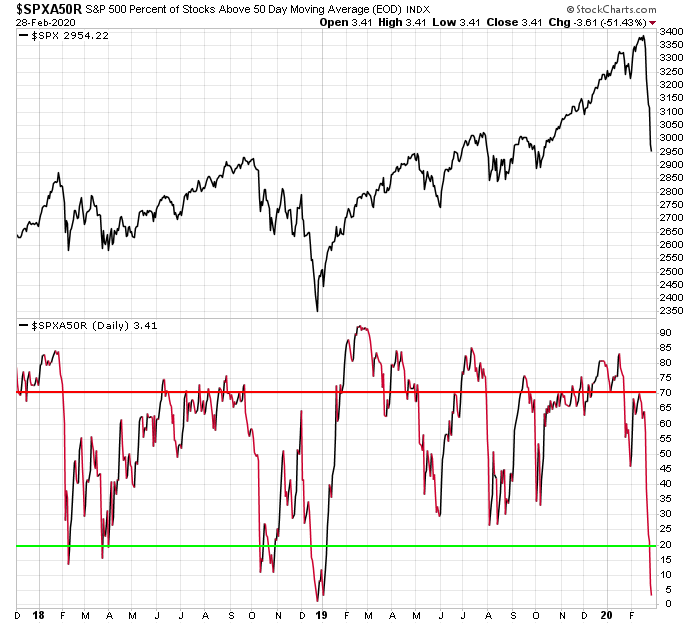

- I discussed in a previous video how the percentage of stocks above the 50-day moving average in the S&P 500 was overdue to fall below the 20% threshold. This happens just about every year in the markets and we went an entire year last year in 2019 without it happening. The fact that we’ve now had this widespread pullback in the market is actually bullish from a short or intermediate term perspective.

- A 10% pullback in the market is not out of the ordinary. In fact it tends to happen every 1-2 years so even though this correction has been fast and full of panic its not unique.

- Amazingly plenty of leading stocks acted well last week with many stocks dramatically outperforming the S&P 500 and some even closing positive on the week.

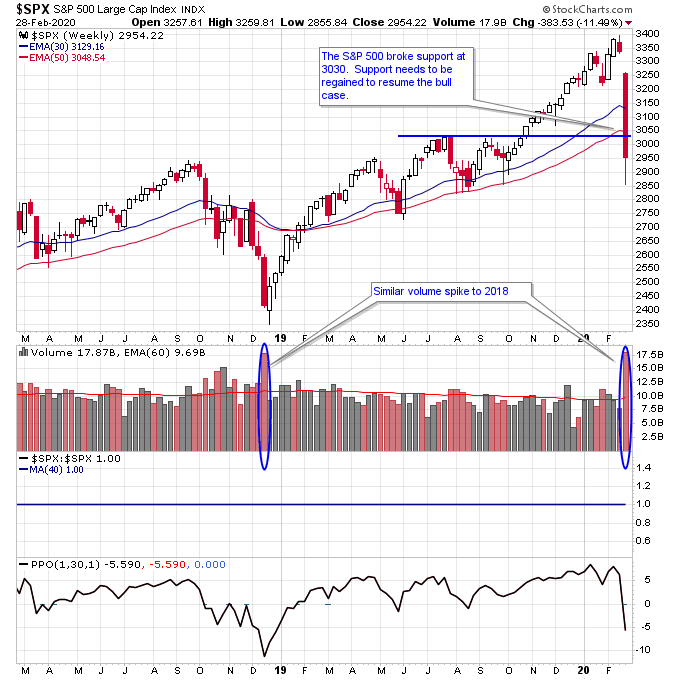

- Taking a look at the S&P 500 it failed to hold support at 3030 which I view as a critical level right now to separate the bull vs. bear case. If 3030 starts to act as resistance on a bounce attempt that’s a negative for the stock market and the market could be in jeopardy of establishing a Stage 4 downtrend. If 3030 is re-taken then the market simply went through a correction and the previous uptrend is being re-established.

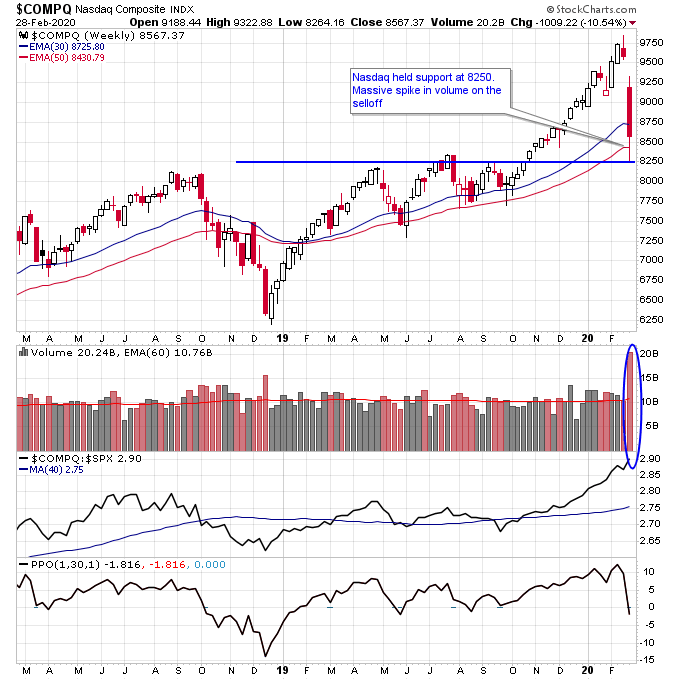

- Also notably the volume on the selloff in both the S&P 500 and Nasdaq was tremendous, usually that type of volume signals capitulation in a downward move in the market. You can see that in 2018 a big volume spike occurred in the S&P 500 during the last week of the bear market. The volume last week actually slightly exceeds that panic volume in 2018.

- The Nasdaq held support at 8250 and bounced significantly from that level and that’s a big positive for the stock market.

- Sector-wise the strongest sectors in the market are still above their 30-week MAs. This include software (IGV), solar (TAN), and the precious metal palladium (PALL).

- In surveying leading stocks last week most of what I noticed was relative strength compared to the S&P 500 vs. leading stocks rolling over and crashing. In bear markets leading stocks tend to do the latter, if you take the 2000 tech bubble for example technology stocks popped and imploded and that is what drove the stock market lower. In 2008 housing stocks which had a massive run before the bubble burst began getting crushed way before the rest of the stock market imploded. This is simply not the case during this correction and that’s a bullish sign for the stock market.

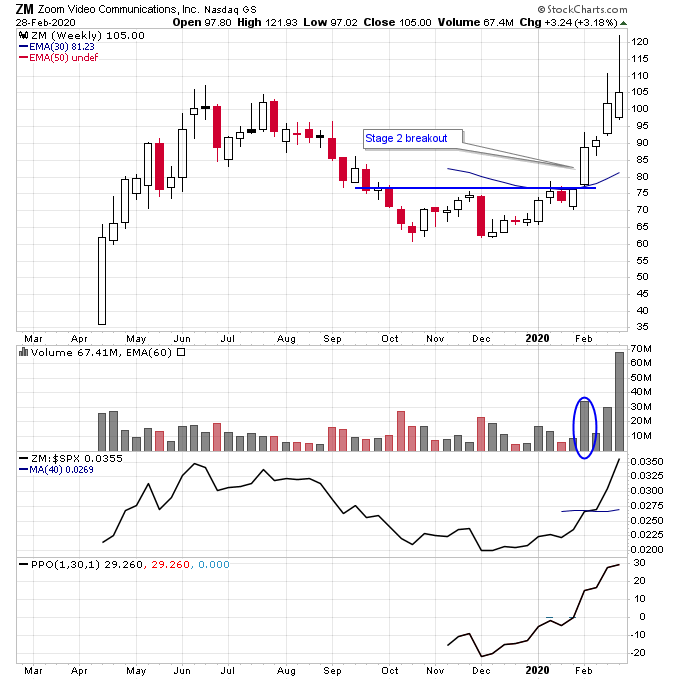

- One of the most important things to do right now besides not panicking and following your trading rules (especially cutting losses on stocks that move into Stage 4) is making a list of stocks that are holding up the best during this correction. Stocks with the least amount of resistance from this pullback that previously had Stage 2 breakouts will more than likely emerge as the next leaders.

- One example would be Zoom Video (ZM) which I highlighted as a Stage 2 breakout a few weeks ago. ZM has held up extremely well during this correction and is still sitting right at new highs while the carnage in other stocks is taking place. Once the pressure from the overall market is lifted stocks like this tend to start leading the market higher.

Disclosure: I am long ZM.

Get more info on Stage Analysis or Stan Weinstein’s book

Check out my trading videos on Youtube

Check out my Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: https://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.